What are the interest rate and term options for online loans?

When it comes to securing online loans in Tanzania, PesaX stands out as a platform offering diverse interest rates and term options tailored to meet varying financial needs. Understanding these facets is crucial for individuals seeking financial assistance. Here’s a comprehensive look at the interest rates and term options available through PesaX:

1. Interest Rates: PesaX offers competitive interest rates on its online loans. The rates are often determined based on several factors, including the applicant’s creditworthiness, loan amount, repayment tenure, and prevailing market conditions.

2. Variable Interest Rates: PesaX may offer both fixed and variable interest rate options. Fixed rates remain constant throughout the loan tenure, providing predictability in monthly payments. Variable rates, however, might fluctuate based on market conditions, potentially resulting in varying monthly payments.

3. Term Options: PesaX provides diverse term options for loan repayment, allowing applicants to choose a repayment tenure that suits their financial situation. These terms can range from short-term loans, typically repaid within a few months, to medium or long-term loans extending to several years.

4. Short-Term Loans: Short-term loans offered by PesaX often come with shorter repayment periods, usually spanning from a few months to a year. These loans are ideal for individuals seeking immediate financial assistance with a quick repayment capability.

Online Credit Loans

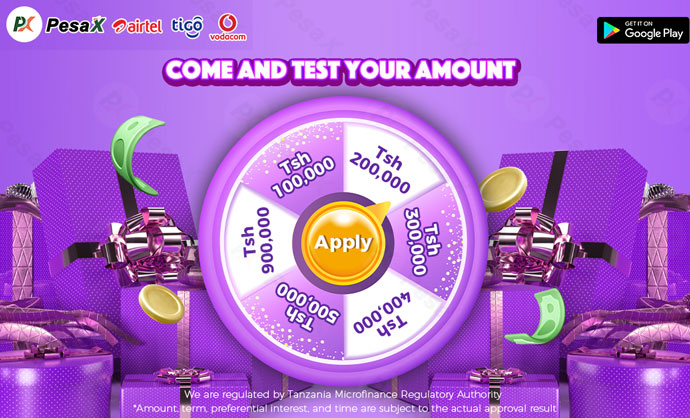

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

5. Medium-Term Loans: Medium-term loans available through PesaX typically have repayment tenures ranging from one to five years. These loans offer a balance between manageable monthly payments and a reasonably extended repayment period.

6. Long-Term Loans: For larger loan amounts, PesaX might offer long-term repayment options extending beyond five years. These loans are suitable for significant financial endeavors, such as home improvements, business expansions, or higher education expenses.

7. Personalized Loan Structures: PesaX aims to cater to individual needs by allowing borrowers to customize loan structures. This includes the flexibility to choose specific repayment periods within the offered range, enabling borrowers to align repayments with their financial capabilities.

8. Factors Affecting Interest Rates and Terms: Several factors influence the interest rates and term options offered by PesaX. These include the applicant’s credit history, income stability, loan amount, and prevailing market conditions. Applicants with strong credit profiles might access loans with lower interest rates and more favorable terms.

9. Transparency and Disclosure: PesaX ensures transparency in disclosing the interest rates and terms associated with each loan product. Applicants can review and understand the specific terms and conditions, including any fees, penalties, or additional charges, before finalizing the loan agreement.

10. Comparing Options and Making Informed Decisions: Prospective borrowers are encouraged to compare the interest rates and term options available on PesaX. By evaluating multiple loan products, applicants can make informed decisions that align with their financial goals and capabilities.

Understanding the range of interest rates and term options offered by PesaX empowers individuals in Tanzania to select loans that best fit their financial needs while ensuring responsible borrowing practices.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status