What factors affect personal loan interest rates?

In the intricate world of personal finance, the interest rate on a personal loan is a pivotal element that directly impacts the overall cost of borrowing. Understanding the factors that influence these interest rates is crucial for borrowers seeking favorable terms and cost-effective financial solutions. This comprehensive article delves into the multifaceted dynamics of personal loan interest rates, shedding light on the key factors that lenders consider and the strategies borrowers can employ to secure more favorable rates.

Introduction to Personal Loan Interest Rates:

-

Significance of Interest Rates:

-

The article begins by highlighting the critical role that interest rates play in personal loans. It explores how these rates are not only the cost of borrowing but also reflect the risk perceived by lenders and various market dynamics.

-

Types of Interest Rates:

-

Different types of interest rates, including fixed and variable rates, are introduced. The article explains the distinctions between these rates and how they impact the overall borrowing experience.

Key Factors Influencing Personal Loan Interest Rates:

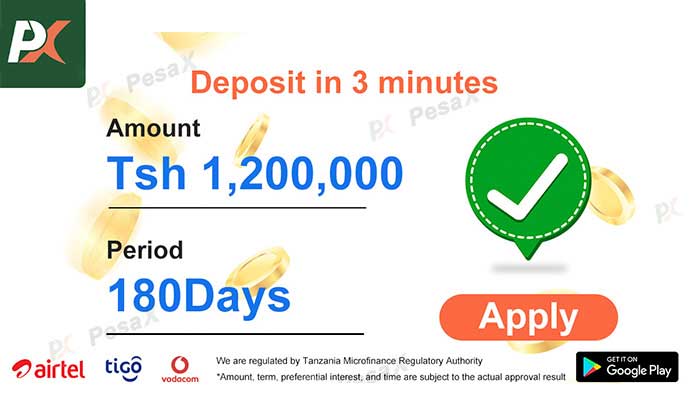

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

-

Credit Score and Credit History:

-

One of the most influential factors is the borrower’s credit score and credit history. The article explores how a higher credit score often translates to lower interest rates, reflecting the borrower’s perceived creditworthiness.

-

Income and Debt-to-Income Ratio:

-

Lenders often consider the borrower’s income and debt-to-income ratio. The article explains how a stable income and a favorable ratio can positively influence interest rates, showcasing the borrower’s financial capacity.

-

Loan Amount and Term:

-

The article delves into how the loan amount and the repayment term impact interest rates. It explains the rationale behind larger loans potentially attracting higher rates and how the term of the loan can affect overall interest costs.

-

Economic Conditions:

-

External economic factors, such as inflation rates and prevailing market conditions, play a role in determining interest rates. The article explores how lenders adjust rates in response to broader economic trends.

-

Lender Policies and Competition:

-

The policies of individual lenders and the competitive landscape also influence interest rates. The article sheds light on how borrowers can benefit from shopping around for the best rates and understanding lender-specific policies.

Strategies for Securing Favorable Interest Rates:

-

Improving Credit Score:

-

The article provides actionable tips on how borrowers can improve their credit scores, emphasizing the long-term benefits of a strong credit profile.

-

Negotiation and Comparison:

-

Borrowers are encouraged to negotiate with lenders and leverage the power of comparison. The article guides readers on how to effectively negotiate for better rates and what factors to consider when comparing loan offers.

-

Optimizing Debt-to-Income Ratio:

-

Strategies for optimizing the debt-to-income ratio are explored. The article provides insights into managing existing debts and making informed financial decisions to enhance this crucial metric.

Navigating Interest Rate Fluctuations:

-

Understanding Variable Rates:

-

For loans with variable interest rates, the article explains how borrowers can navigate fluctuations. It offers insights into the factors influencing variable rates and strategies for managing potential changes.

-

Locking in Fixed Rates:

-

The article explores the benefits of choosing fixed interest rates, providing stability and predictability for borrowers. It guides readers on when opting for fixed rates may be advantageous.

The Role of Technology and Online Lenders:

-

Technology’s Impact on Rates:

-

The article discusses how technology has influenced the lending landscape, with online lenders often offering competitive rates. It explores the efficiencies introduced by technology and how borrowers can leverage these advancements.

-

Online Lenders vs. Traditional Institutions:

-

A comparison between online lenders and traditional institutions is presented. The article highlights the advantages of online lending platforms, including faster processes and potentially lower overhead costs.

In conclusion, personal loan interest rates are a nuanced aspect of borrowing that requires careful consideration. The article empowers readers with a comprehensive understanding of the factors influencing these rates and provides actionable strategies for securing more favorable terms. Whether navigating credit scores, optimizing financial metrics, or leveraging technological advancements, borrowers armed with knowledge can make informed decisions that align with their financial goals. Understanding the dynamics of personal loan interest rates is not only a key to cost-effective borrowing but also a pathway to financial empowerment.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status