How can I get a personal loan with PesaX if I have a bad credit score?

In the landscape of traditional finance, a less-than-ideal credit score can often be a barrier to accessing personal loans. However, PesaX breaks the mold, offering individuals in Tanzania an opportunity to secure personal loans even in the face of a challenging credit history. This comprehensive article serves as a guide, providing readers with insights on how to navigate the PesaX platform and obtain a personal loan, transcending the limitations of a bad credit score.

1. Introduction to PesaX’s Inclusive Approach:

The article begins by introducing readers to PesaX’s commitment to financial inclusion. It highlights the platform’s inclusive approach, where individuals with bad credit scores are not automatically excluded from accessing personal loans.

2. Understanding the Impact of Credit Scores:

A bad credit score can be a roadblock in traditional financing. The article delves into the conventional impact of credit scores, emphasizing the need for alternative solutions for individuals facing credit challenges.

3. The PesaX Advantage for Borrowers with Bad Credit:

PesaX’s unique approach takes center stage. The article explores the advantages that PesaX offers to borrowers with bad credit, including a holistic evaluation process that goes beyond traditional credit scores.

4. Creating Your PesaX Account:

Online Credit Loans

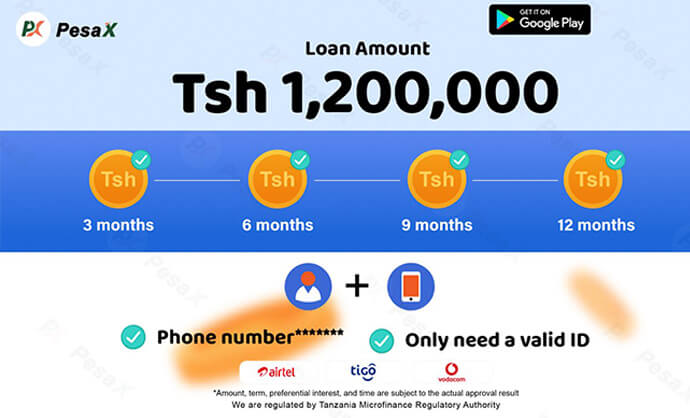

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

The article guides readers through the initial steps, starting with the creation of a PesaX account. This seamless onboarding process ensures that users, irrespective of their credit scores, can access the platform.

5. Navigating the User-Friendly Interface:

Understanding the user-friendly interface is crucial. The article walks readers through the different sections of the PesaX app, emphasizing its intuitive design for users with varying levels of digital literacy.

6. Diverse Personal Loan Products Available:

PesaX offers a variety of personal loan products. The article provides insights into these offerings, including their features, repayment terms, and customization options, catering to the diverse financial needs of borrowers with bad credit.

7. Customizing Your Personal Loan Despite Bad Credit:

Personalization is a key feature of PesaX. The article explores how users with bad credit can customize their personal loans, tailoring the amount and repayment terms to suit their specific financial situations.

8. Holistic Evaluation Process:

PesaX’s holistic evaluation process is a game-changer. The article delves into how this approach considers various factors beyond credit scores, potentially broadening access to personal loans for individuals with diverse financial histories.

9. Real-Time Evaluation and Approval:

PesaX’s real-time evaluation ensures prompt responses. The article explores how this feature facilitates users, including those with bad credit, to receive timely feedback on their eligibility and approval status.

10. Responsible Borrowing with Bad Credit:

Responsible borrowing is encouraged, even for individuals with bad credit. The article provides practical tips for users to make informed decisions, considering factors such as repayment capacity and financial planning.

11. Security Measures for Personal Loan Data:

Security is paramount in personal loan transactions. The article discusses the robust security measures implemented by PesaX, reassuring users that their personal and financial data is safeguarded against potential cyber threats.

12. User Support for Personal Loan Queries:

The article emphasizes the availability of user support for personal loan queries. Users gain insights into the channels through which they can seek assistance or clarification, ensuring a smooth and transparent experience.

In conclusion, PesaX redefines financial possibilities for individuals with bad credit. This comprehensive guide equips readers with the knowledge to navigate the app confidently, from creating an account to securing personal loans despite credit challenges. PesaX emerges not only as a financial platform but as a beacon of inclusivity, offering a lifeline to those facing credit hurdles on their journey to financial well-being.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status