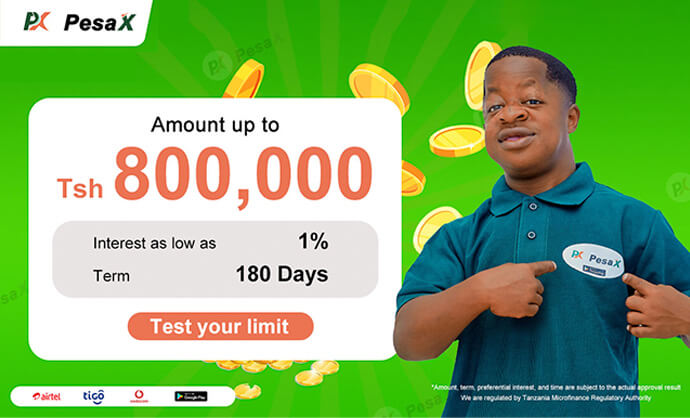

Tanzania PesaX provides you with unsecured fast loan services

In the ever-evolving world of financial services, Tanzania’s PesaX takes center stage by offering unsecured fast loan services, revolutionizing the way individuals access quick financial solutions. This comprehensive article delves into the distinctive features and advantages that make PesaX a trailblazer in the realm of unsecured fast loans, spotlighting its role in empowering Tanzanians with financial flexibility and convenience.

1. Introduction to PesaX:

The article opens with an introduction to PesaX, positioning it as a leading provider of unsecured fast loan services in Tanzania. Readers gain an overview of PesaX’s mission and its commitment to reshaping the financial landscape.

2. Unsecured Fast Loan Services Defined:

Defining the concept of unsecured fast loans, the article elucidates how PesaX stands out by delivering financial solutions without the requirement for collateral. This approach ensures a streamlined borrowing experience for users.

3. PesaX’s Pledge to Swift Solutions:

A distinguishing feature of PesaX is its dedication to speed. The article explores how the platform accelerates the loan application and approval processes, ensuring users receive the financial assistance they need promptly.

4. User-Friendly Interface:

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

Navigating through PesaX’s user-friendly interface is crucial for a positive user experience. The article provides insights into the platform’s design, spotlighting its intuitive features for quick and effortless navigation.

5. Creating an Account on PesaX:

A step-by-step guide is presented on creating an account on PesaX, ensuring users can easily onboard and initiate the process of securing unsecured fast loans tailored to their unique financial requirements.

6. Real-Time Evaluation and Approval:

PesaX’s real-time evaluation process takes center stage. The article details how this feature ensures users receive rapid responses regarding their eligibility and approval status, streamlining the loan application journey.

7. Customizing Repayment Plans:

Personalization becomes a focal point on PesaX. The article explores how users can customize their repayment plans, tailoring terms to align with their specific financial circumstances and ensuring a stress-free repayment process.

8. Instant Disbursement of Funds:

The article emphasizes the rapid disbursement of funds with PesaX. Once a loan is approved, users can access the funds instantly, addressing their financial needs without unnecessary delays.

9. Security Measures for Loan Transactions:

Security emerges as a paramount concern in financial transactions. The article discusses the robust security measures implemented by PesaX, assuring users that their sensitive information is safeguarded.

10. PesaX’s Role in Financial Inclusion:

The article concludes by highlighting PesaX’s significant role in advancing financial inclusion in Tanzania. Through the provision of unsecured fast loans, the platform plays a pivotal role in democratizing access to financial resources.

11. User Testimonials and Success Stories:

Integrating user testimonials and success stories enriches the narrative, providing a firsthand account of the real-world impact of PesaX on individuals’ financial journeys.

12. PesaX – Transforming Financial Dynamics:

In conclusion, the article reaffirms PesaX’s transformative role in Tanzania’s financial landscape. By offering premier unsecured fast loans, PesaX spearheads a paradigm shift in how Tanzanians navigate financial challenges, fostering a culture of financial agility and accessibility.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status