PesaX helps you quickly obtain unsecured loans for emergency expenses

In the ever-evolving financial services landscape, PesaX serves as a beacon of support, providing a seamless way for individuals to quickly obtain unsecured loans to address emergency expenses. This comprehensive article introduces the key features that make PesaX a reliable solution for urgent financial needs, highlighting its commitment to speed, accessibility, and responsible lending practices.

1.PesaX introduction:

The article begins with an introduction, positioning PesaX as an important player in the financial services space. It sets the stage for an in-depth exploration of how the platform can facilitate quick access to Unsecured quick loans, especially in emergencies.

2. Fast and safe borrowing:

This article takes an in-depth look at PesaX’s core principles – providing fast, secure lending options. It highlights how the efficiency of a platform can be a critical factor, especially when individuals are grappling with unexpected and urgent financial needs.

3. Zero collateral requirements:

A key feature of PesaX is its commitment to inclusivity. This article explores how PesaX’s zero-collateral requirement democratizes the lending process, allowing a wider range of individuals to access funds without the burden of traditional collateral.

4. User-friendly interface for quick navigation:

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

Navigation of the user-friendly interface of PesaX is explored in detail. The article highlights how the platform’s design ensures users can quickly navigate the loan application process, making it simple and efficient.

5. Real-time application and approval process:

PesaX’s real-time application and approval process takes center stage. This article outlines how the platform’s rapid assessment ensures users receive timely responses regarding their eligibility, streamlining the entire loan acquisition process.

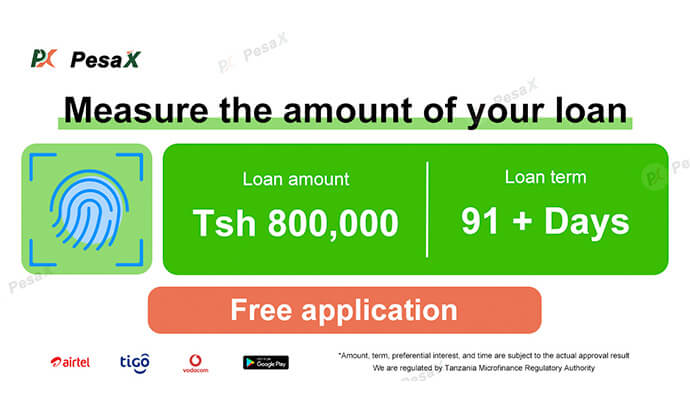

6. Tailored repayment plan:

Personalization becomes the focus of PesaX’s customized repayment plans. This article details how users can customize repayment terms to align with their specific financial situation for a more flexible and manageable repayment process.

7. Instant payment of funds:

The article highlights the rapid disbursement of PesaX funds. Once a loan is approved, users have immediate access to funds, allowing them to quickly address emergency expenses without unnecessary delays.

8. Security measures for user confidence:

The security measures implemented by PesaX are designed to increase user confidence. The article reassures readers that their sensitive information is protected, thereby reinforcing trust in the platform’s commitment to data security.

9. Impact on financial health:

The broader impact of PesaX on financial health is discussed. This article highlights how the platform’s fast and responsible lending practices contribute to an individual’s overall financial well-being during challenging times.

10. User testimonials and success stories:

Integrating user testimonials and success stories enriches the narrative, providing real-world examples of how PesaX can be a reliable partner in helping individuals cope with emergency financial situations.

11.PesaX – Pillar of support in times of financial emergencies:

In summary, this article reinforces PesaX’s role as a backbone of support during financial emergencies. By providing fast, unsecured loan services, the platform becomes a trusted ally for individuals looking for instant financial solutions, embodying the essence of financial agility and responsibility.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status