Are unsecured quick loans easy to get?

In the dynamic landscape of financial services, the accessibility of unsecured quick loans has become a pivotal topic for individuals seeking rapid financial solutions. This comprehensive article explores the factors that contribute to the ease of obtaining unsecured quick loans, shedding light on the processes, benefits, and considerations for borrowers.

1. Introduction: The Landscape of Unsecured Quick Loans

The article begins by setting the stage, introducing the concept of unsecured quick loans and their significance in addressing immediate financial needs. It establishes the context for understanding the ease of obtaining such loans.

2. Understanding Unsecured Loans: A Primer

Delving into the basics, the article provides a clear explanation of what unsecured loans entail. It distinguishes them from secured loans, highlighting the absence of collateral requirements.

3. The Appeal of Quick Loans: Urgency and Convenience

The swift nature of quick loans becomes a focal point. The article explores why individuals are drawn to these loans, emphasizing their urgency and the convenience they offer in critical financial situations.

4. The Role of Technology: Digital Platforms and Quick Loans

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

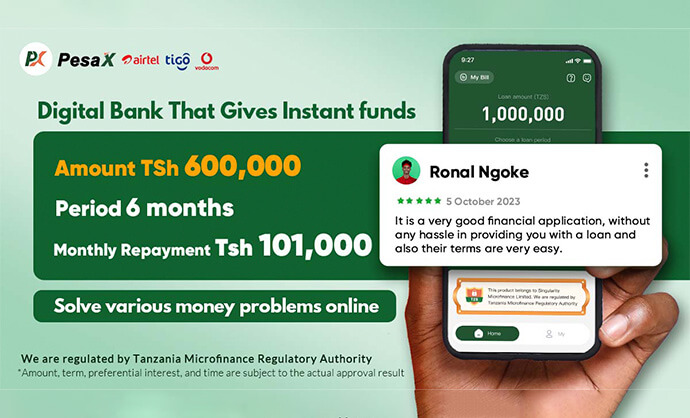

Technology’s impact on the accessibility of unsecured quick loans is explored. The article discusses how digital platforms, like PesaX, streamline the application process, making it faster and more user-friendly.

5. The Application Process: Simplified for Efficiency

A step-by-step guide to the application process is provided. The article breaks down how platforms like PesaX have simplified the steps, ensuring that users can navigate through the process with ease.

6. Real-Time Approval: Speeding Up the Decision-Making Process

The article highlights the significance of real-time approval. It explains how this feature accelerates the decision-making process, providing borrowers with prompt responses regarding their loan eligibility.

7. Zero Collateral Requirement: Democratizing Access to Loans

The absence of collateral requirements in unsecured loans is a game-changer. The article discusses how this democratizes access to loans, making them more inclusive and accessible to a broader range of individuals.

8. Credit Score Considerations: A Balanced Approach

While collateral might not be necessary, credit scores play a role. The article explores how platforms balance the need for financial history without making it a barrier for individuals with less-than-perfect credit.

9. Personalization of Repayment Plans: Tailoring to Individual Needs

The personalization of repayment plans is a key feature. The article delves into how borrowers can customize their plans to suit their financial situations, ensuring a more manageable repayment process.

10. Building Trust: Security Measures and User Confidence

Trust is paramount in financial transactions. The article discusses the security measures implemented by platforms, reassuring users about the confidentiality and protection of their sensitive information.

11. User Experiences: Testimonials and Success Stories

Integrating user testimonials and success stories humanizes the narrative. The article provides real-world examples of individuals who have successfully obtained unsecured quick loans, showcasing the positive impact on their lives.

12. Unsecured Quick Loans – A Beacon of Financial Convenience

In conclusion, the article reaffirms that unsecured quick loans are indeed easy to obtain, especially with the advancements in technology and the user-centric approaches of platforms like PesaX. It emphasizes their role as a beacon of financial convenience for those navigating urgent and unexpected financial needs.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status