What are the application conditions for pesax loans in Tanzania?

Pesax, a prominent financial technology company in Tanzania, provides users with convenient access to loans through its mobile application. To empower potential borrowers, this article delves into the specific loan application requirements set by Pesax in Tanzania. Understanding these criteria is essential for individuals seeking financial assistance and allows them to assess their eligibility before embarking on the loan application process.

Age Requirements:

Pesax typically sets a minimum age requirement for loan applicants. Borrowers are usually required to be at least 18 years old to be eligible for Pesax loans. Verifying age helps ensure that applicants have legal capacity and responsibility for entering into financial agreements.

Residency Status:

Pesax loans are generally available to Tanzanian residents. Applicants are typically required to provide proof of residency, such as a valid national identification card or any other document confirming their legal residence in Tanzania.

Valid Identification Documents:

A crucial aspect of the loan application process is the submission of valid identification documents. Pesax typically requires applicants to provide a government-issued identification document, such as a national ID card, passport, or driver’s license. This verification ensures the accuracy of user information and aids in preventing identity fraud.

Steady Source of Income:

To assess the borrower’s ability to repay the loan, Pesax typically requires evidence of a steady source of income. This could include salary statements, bank statements, or any other documentation that demonstrates a regular and reliable income stream. A stable income is a key factor in determining loan eligibility.

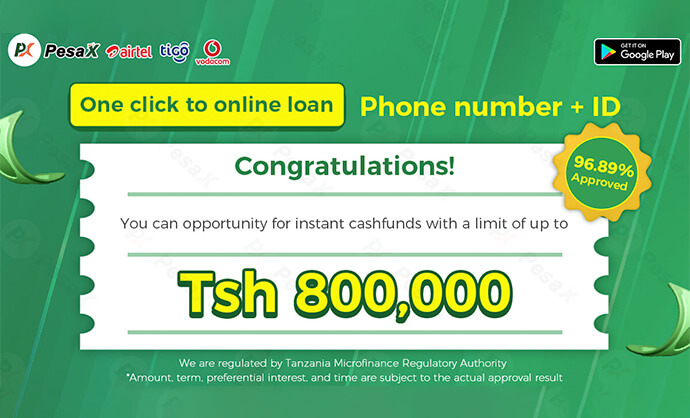

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

Employment Verification:

Pesax may require applicants to provide details about their employment, including the name of the employer, job title, and contact information. Employment verification helps validate the income information provided and ensures that applicants have a source of income.

Credit History Assessment:

While Pesax may be more inclusive than traditional lenders, it may still assess the credit history of applicants. The evaluation of credit history helps the platform gauge the creditworthiness of borrowers and tailor loan offerings accordingly.

Mobile Phone and Pesax App Access:

Given that Pesax operates through a mobile application, applicants are typically required to have access to a mobile phone and the Pesax app. This ensures that users can complete the application process seamlessly and stay informed about their loan status and repayment details.

Bank Account Details:

To facilitate loan disbursement and repayment, Pesax may request applicants to provide their bank account details. This information is essential for the secure and efficient transfer of funds between Pesax and the borrower.

Consent to Terms and Conditions:

Before finalizing the loan application, Pesax typically requires applicants to consent to the platform’s terms and conditions. This includes agreeing to the specified interest rates, repayment schedules, and any other relevant terms associated with the loan.

Compliance with Pesax Policies:

Pesax sets specific policies governing its loan offerings, and applicants are typically required to comply with these policies. This includes adhering to guidelines related to responsible borrowing, repayment schedules, and any other conditions outlined by Pesax.

Pesax’s loan application requirements in Tanzania are designed to balance accessibility with responsible lending practices. By understanding these criteria, potential borrowers can assess their eligibility and prepare the necessary documentation before applying for a loan. This transparency in requirements contributes to a smoother application process and empowers individuals to access financial assistance through Pesax’s user-friendly platform.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status