What are the user reviews and reputation of pesax online loans in Tanzania?

In the dynamic landscape of online lending, user reviews and reputation play a pivotal role in shaping perceptions and choices. This article dives into the user reviews and reputation of Pesax online loans in Tanzania, aiming to provide insights into how the platform is perceived by its user base.

User Testimonials and Reviews:

Pesax, like many online lending platforms, often features user testimonials and reviews on its website or within its application. These firsthand accounts offer a glimpse into the real experiences of borrowers, providing valuable insights into the platform’s strengths and areas for improvement.

Online Platforms and Forums:

Beyond the official channels, users often share their experiences on online platforms and forums. These discussions can be insightful, offering a more comprehensive view of the overall sentiment surrounding Pesax online loans. Popular review websites and social media platforms are common spaces where users express their opinions.

Overall Reputation:

The overall reputation of Pesax in Tanzania is shaped by the collective experiences of its users. Positive reviews contribute to a favorable reputation, highlighting the platform’s strengths, reliability, and effectiveness in meeting users’ financial needs. Conversely, negative reviews may point to areas of concern or improvement.

Customer Satisfaction Ratings:

Some online platforms allow users to rate their satisfaction with Pesax’s services. Customer satisfaction ratings provide a quantitative measure of how well the platform meets the expectations and needs of its users. A high satisfaction rating generally indicates a positive user experience.

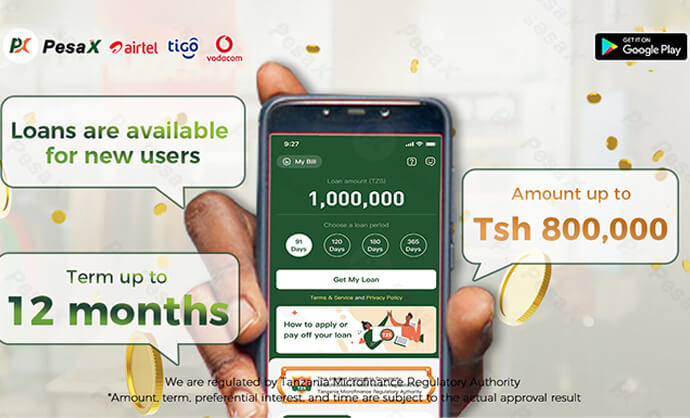

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

Ease of Use and Application Process:

User reviews often touch upon the ease of use of Pesax’s mobile application and the simplicity of the loan application process. Positive feedback in this area suggests that the platform is successful in providing a user-friendly experience, while negative comments may signal areas for improvement.

Loan Approval Speed:

The speed of loan approval is a crucial factor for many borrowers. Reviews may highlight the efficiency of Pesax in quickly approving and disbursing loans. A fast and streamlined process is typically well-received by users in need of immediate financial assistance.

Transparency in Terms and Conditions:

Users appreciate transparency in loan terms and conditions. Positive reviews often mention Pesax’s clear communication regarding interest rates, fees, and repayment schedules. Transparent practices contribute to trust and responsible borrowing.

Customer Support Effectiveness:

The effectiveness of customer support is a key aspect of user reviews. Positive experiences with Pesax’s customer support team, such as prompt responses and helpful assistance, contribute to a positive overall reputation. Negative experiences may raise concerns about the platform’s support services.

Handling of Disputes and Issues:

How Pesax handles disputes or issues raised by users is reflected in their reviews. Platforms that demonstrate a proactive approach in resolving concerns tend to maintain a more positive reputation. User feedback sheds light on how well Pesax addresses and resolves issues.

Educational Resources and Financial Literacy:

Users may share their experiences with Pesax’s educational resources and initiatives aimed at promoting financial literacy. Positive feedback in this regard highlights the platform’s commitment to empowering users with knowledge about responsible borrowing and financial management.

Security and Privacy:

Reviews may touch upon users’ perceptions of Pesax’s security measures and privacy standards. Positive comments regarding the security of personal and financial information contribute to a favorable reputation, while concerns in this area may impact user trust.

User reviews and reputation are integral aspects of evaluating Pesax online loans in Tanzania. The collective experiences of users provide valuable insights into the platform’s strengths, weaknesses, and overall performance. As borrowers consider Pesax for their financial needs, understanding the sentiments expressed in user reviews contributes to making informed decisions about engaging with the platform.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status