Are there any promotions or policies to support the interest rates and fees of Pesax online loans?

Introduction:

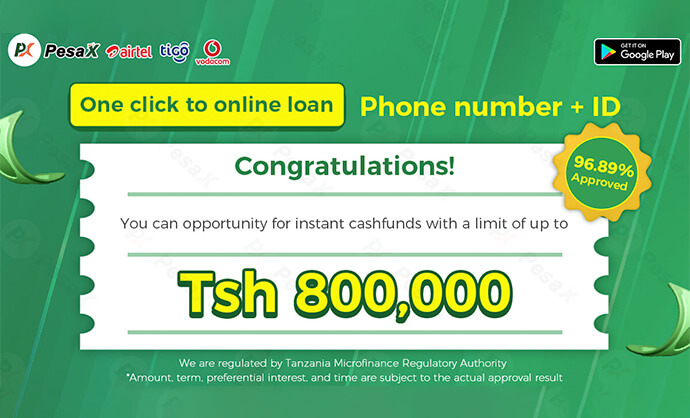

Pesax is an online lending platform that offers convenient and accessible loan services to individuals. In this article, we will explore whether Pesax provides any preferential rates and fee policies to its borrowers, taking into account any promotional activities or government support.

1. Pesax’s Standard Loan Rates and Fees:

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

Pesax follows a transparent approach when it comes to its loan rates and fees. The interest rate and other charges are clearly stated in their loan agreement. Borrowers can expect competitive rates based on their creditworthiness and the duration of the loan. Pesax ensures that borrowers are aware of all the costs involved upfront.

2. Promotional Activities:

Pesax frequently runs promotional activities to attract new borrowers and reward loyal customers. These promotions may include discounted interest rates, waived processing fees, or cashback offers. By keeping an eye on Pesax’s website or subscribing to their newsletter, borrowers can stay updated about ongoing promotional activities and take advantage of these benefits.

3. Seasonal Offers:

During certain periods of the year, such as holidays or festive seasons, Pesax may introduce special offers for borrowers. These offers could include lower interest rates, extended repayment periods, or reduced fees. Such seasonal offers provide an opportunity for borrowers to access loans at more favorable terms and conditions.

4. Referral Programs:

Pesax often encourages borrowers to refer their friends or family members to the platform. In return, both the existing borrower and the referred individual can receive benefits, such as reduced interest rates or referral bonuses. This referral program not only incentivizes existing borrowers but also expands Pesax’s customer base.

5. Government Support and Policies:

In some cases, governments may implement policies to support the growth of online lending platforms and promote financial inclusion. These policies could include providing subsidies, tax incentives, or low-interest loans to these platforms. As a result, online lenders like Pesax may be able to offer more favorable rates and fees to borrowers.

6. Transparency and Customer Satisfaction:

One of Pesax’s key focuses is maintaining transparency in its operations. The company strives to provide clear information about its rates, fees, and any promotional activities to ensure that borrowers can make informed decisions. Additionally, Pesax values customer satisfaction and aims to address any concerns or issues promptly.

Conclusion:

Pesax, as an online lending platform, offers various benefits to its borrowers through preferential rates and fee policies. These include promotional activities, seasonal offers, referral programs, and potential government support. Borrowers can take advantage of these opportunities to access loans at more favorable terms and conditions. With transparent operations and a focus on customer satisfaction, Pesax aims to provide a reliable and convenient lending experience for individuals in need of financial assistance.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status