Does Pesax Online Loan provide preferential policies and event support?

When it comes to online loans, one of the key considerations for potential borrowers is whether the platform offers any special promotions or supportive activities. In this article, we will delve into Pesax’s approach to providing advantageous policies and engaging activities to its customers, ensuring a comprehensive understanding of the benefits available. From promotional offers to supportive initiatives, we’ll explore how Pesax goes the extra mile to cater to the diverse needs of its clientele.

Special Promotional Offers

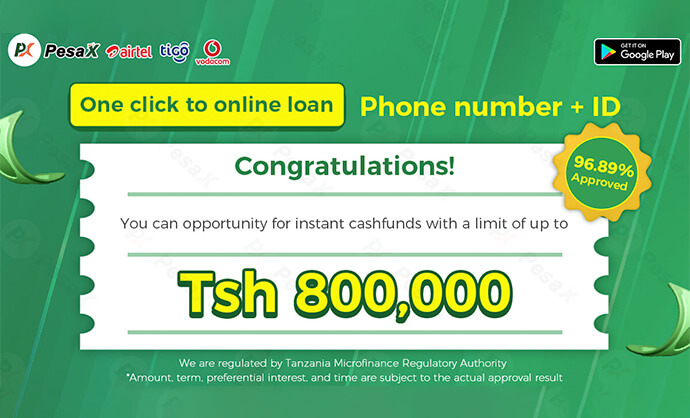

Pesax takes pride in offering special promotional offers to its customers, aiming to provide added value and affordability. These promotions may include reduced interest rates for first-time borrowers, referral bonuses for existing clients, or seasonal discounts during festive periods. By availing of these offers, borrowers can experience cost savings and enhanced financial flexibility, making Pesax an attractive choice for those seeking online loans.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

Flexible Repayment Schemes

In addition to promotional offers, Pesax provides flexible repayment schemes that align with the diverse financial circumstances of its customers. This may involve the option to customize repayment schedules, deferment of payments under specific conditions, or the possibility of early repayment without incurring additional fees. Such flexibility empowers borrowers to manage their loan commitments effectively, fostering a positive and sustainable borrowing experience.

Customer Loyalty Programs

To reward loyal customers, Pesax has established customer loyalty programs that offer exclusive benefits and privileges. Through these programs, frequent borrowers can access higher loan amounts, lower interest rates, or dedicated customer support channels. By nurturing a sense of loyalty, Pesax aims to foster long-term relationships with its customers and provide ongoing value beyond individual transactions.

Financial Literacy Workshops

Recognizing the importance of financial literacy, Pesax conducts regular workshops and educational sessions aimed at empowering its customers with valuable knowledge and skills. These workshops cover topics such as budgeting, investment planning, and debt management, equipping borrowers with the tools to make informed financial decisions. By investing in customer education, Pesax demonstrates its commitment to promoting financial well-being within the community.

Community Engagement Initiatives

Beyond its core lending services, Pesax actively engages in community initiatives to support various social causes and local development projects. This may involve partnering with non-profit organizations, participating in environmental conservation efforts, or sponsoring educational programs. Through these initiatives, Pesax exemplifies its role as a responsible corporate citizen, contributing to the betterment of society while engaging with its customer base on a deeper level.

Conclusion

In conclusion, Pesax distinguishes itself in the realm of online loans by offering a range of promotions, supportive activities, and customer-centric initiatives. From special offers and flexible repayment schemes to loyalty programs and community engagement, Pesax goes above and beyond to cater to the diverse needs of its clientele. By prioritizing customer satisfaction and holistic financial well-being, Pesax sets a standard for excellence in the online lending industry, creating a positive impact that extends beyond the realm of traditional borrowing.

Overall, Pesax’s commitment to providing advantageous policies and engaging activities reinforces its position as a reputable and customer-focused online loan provider, setting it apart as a preferred choice for individuals seeking reliable financial solutions.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status