What are the future developments and trends of Pesax online lending?

In recent years, the popularity of online loans has continued to rise as more people turn to digital platforms for their financial needs. As a leading online lending platform, Pesax has unique insights into the future development and trends of online loans. In this article, we will explore the key factors driving the growth of online lending and what the future holds for this industry.

1. The Convenience of Online Lending

One of the main reasons why online lending has become so popular is due to its convenience. With just a few clicks, borrowers can apply for a loan and receive funds directly into their bank account. This eliminates the need to visit physical branches and fill out lengthy paperwork, making the process much faster and simpler.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

2. The Rise of Mobile Technology

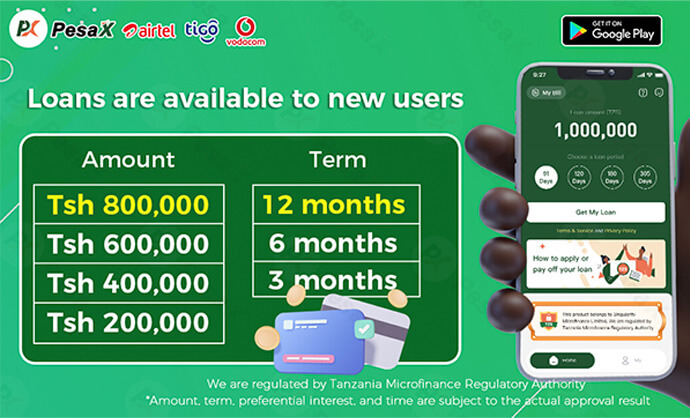

As mobile technology becomes increasingly ubiquitous, more people are turning to their smartphones and tablets to manage their finances. This has created a huge opportunity for online lenders to reach new customers and provide them with quick and easy access to credit. Pesax has been at the forefront of this trend, developing a mobile app that allows borrowers to apply for loans on-the-go.

3. Greater Flexibility and Personalization

Online lending also offers greater flexibility and personalization compared to traditional banks. Borrowers can choose from a wide range of loan products that cater to their specific needs and preferences. Additionally, online lenders often use advanced algorithms to assess a borrower’s creditworthiness, which can result in more favorable loan terms and lower interest rates.

4. Increased Transparency and Trust

The online lending industry has come a long way in terms of transparency and trust. Many reputable lenders like Pesax have implemented strict regulations and policies to protect borrowers and ensure fair lending practices. This has helped to build trust among borrowers and has made online lending a viable alternative to traditional banks.

5. Integration with Other Financial Services

In the future, we can expect to see online lending become more integrated with other financial services like digital banking and investment platforms. This will provide borrowers with a more holistic and streamlined experience, allowing them to manage all aspects of their finances from a single platform.

6. Continued Growth and Innovation

Overall, the future of online lending looks bright. As more people turn to digital platforms for their financial needs, online lenders like Pesax will continue to thrive and innovate. We can expect to see new loan products, advanced technology, and greater convenience as the industry evolves to meet the changing needs of consumers.

Conclusion

The growth of online lending shows no signs of slowing down. With its convenience, personalization, and transparency, it offers a compelling alternative to traditional banks. As mobile technology continues to advance and the industry becomes more integrated with other financial services, we can expect to see even more innovation and growth in the years to come. As a leading online lending platform, Pesax is well-positioned to lead the way in this exciting and rapidly-evolving industry.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status