What are the repayment options on the PesaX Loan App in Tanzania?

PesaX is a popular loan app in Tanzania that provides users with convenient access to financial assistance. One of the crucial aspects of borrowing money is the repayment, and PesaX offers various repayment options to cater to the diverse needs of its users. In this article, we will explore the different repayment methods provided by the PesaX loan app.

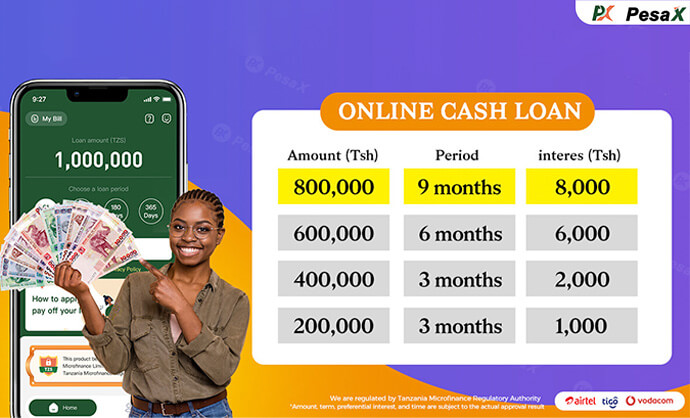

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

1. Direct Debit

Direct debit is one of the primary repayment options offered by PesaX. This method allows users to link their bank accounts or mobile money wallets to the app. Once the repayment date arrives, the app automatically debits the specified amount from the linked account, ensuring timely repayment without the need for manual intervention. This convenience makes direct debit a popular choice among PesaX users.

2. Mobile Money Transfer

For individuals who prefer using mobile money services, PesaX also supports repayment through mobile money transfer. Users can simply initiate a transfer from their mobile money wallets to the PesaX loan app, settling their outstanding dues hassle-free. This option appeals to those who rely heavily on mobile money for their financial transactions.

3. Bank Deposit

PesaX understands the importance of flexibility, and thus, it offers the option of repaying the loan through bank deposits. Users can visit designated bank branches and deposit the repayment amount into the specified PesaX account. While this method may require physical effort, it provides an alternative for individuals who prefer traditional banking services.

4. Salary Deduction

Another innovative repayment option provided by PesaX is salary deduction. Through partnerships with various employers, PesaX facilitates the deduction of loan repayments directly from the borrower’s salary. This seamless process ensures that repayments are prioritized and eliminates the risk of missed payments, benefiting both the users and their employers.

5. Online Payment Platforms

In line with technological advancements, PesaX integrates with popular online payment platforms, allowing users to repay their loans through these channels. Whether it’s through third-party payment gateways or the app’s own online portal, borrowers can leverage the convenience of digital payments to fulfill their repayment obligations.

6. Cash Payments at Partner Locations

Recognizing the importance of accessibility, PesaX has established partnerships with various agents and service points where users can make cash payments towards their loans. This option caters to individuals who prefer conducting financial transactions in person and is particularly beneficial for those residing in areas with limited access to digital payment facilities.

In conclusion, PesaX offers a comprehensive range of repayment options to ensure that borrowers can fulfill their obligations conveniently. Whether it’s through automated methods like direct debit and salary deduction, or more traditional approaches such as bank deposits and cash payments, PesaX accommodates the diverse preferences of its users, promoting responsible and stress-free loan management.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status