What is the success rate of PesaX loan application in Tanzania?

Tanzania has experienced a rapid growth in the use of mobile money and digital financial services over the past decade. As a result, various mobile applications have emerged to cater to the financial needs of Tanzanians. One such application is PesaX, a loan app that has gained significant popularity in recent years. This article will delve into the success rate of the PesaX loan app in Tanzania, highlighting its features, benefits, and impact on the local population.

1. Introduction to PesaX

PesaX is a mobile-based lending platform that provides instant micro-loans to individuals in Tanzania. The app was developed by a local fintech company with the aim of providing accessible and affordable credit to the unbanked and underbanked populations. PesaX stands out for its user-friendly interface, simplified loan application process, and quick disbursement of funds.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

2. Easy Application and Approval Process

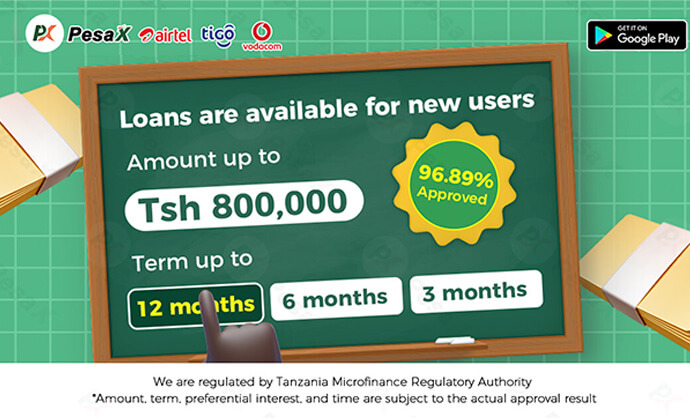

One of the key factors contributing to the success of PesaX is its simple application and approval process. Users can download the app from the Google Play Store, create an account, and complete the loan application within minutes. The app utilizes alternative data sources, such as mobile phone usage patterns and social media activity, to assess the creditworthiness of applicants. This innovative approach allows PesaX to reach a wider customer base and provide loans to individuals who may not have a traditional credit history.

3. Quick Disbursement of Funds

Once a loan application is approved, PesaX ensures the prompt disbursement of funds directly to the borrower’s mobile money account. This feature is particularly beneficial for individuals who require immediate financial assistance for emergencies or unexpected expenses. The seamless transfer of funds eliminates the need for physical visits to banks or lengthy approval processes, making PesaX a convenient and reliable source of credit.

4. Flexible Repayment Options

PesaX offers flexible repayment options tailored to the needs of its users. Borrowers can choose between various repayment terms, ranging from a few days to several months, depending on their financial capabilities. The app sends timely reminders and notifications to borrowers, helping them stay on track with their repayments. Additionally, PesaX rewards responsible borrowers by offering lower interest rates and higher loan limits for future loans.

5. Positive Impact on Financial Inclusion

The success of PesaX can be attributed to its significant contribution to financial inclusion in Tanzania. By providing instant access to credit, PesaX empowers individuals to meet their financial obligations, invest in income-generating activities, and improve their standard of living. The app has played a crucial role in bridging the gap between the formal financial sector and the unbanked population, allowing more Tanzanians to participate in the digital economy.

6. Customer Satisfaction and Growth

PesaX has garnered positive reviews and high customer satisfaction rates among its users. Many borrowers appreciate the convenience, speed, and transparency of the app’s services. PesaX’s success can also be measured by its steady growth in terms of user acquisition and loan disbursals. As the app continues to expand its reach and enhance its product offerings, it is expected to further increase its success rate in Tanzania’s financial landscape.

Conclusion

In conclusion, the PesaX loan app has achieved considerable success in Tanzania due to its easy application process, quick disbursement of funds, flexible repayment options, and positive impact on financial inclusion. Its user-friendly interface and innovative credit assessment methods have made it a popular choice among individuals seeking instant micro-loans. As PesaX continues to evolve and adapt to the changing needs of its users, it is poised to maintain its success and contribute to the financial empowerment of Tanzanians.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status