How to Obtain a Loan in an Emergency

In times of financial emergencies, obtaining a loan can provide much-needed relief. Whether it’s unexpected medical expenses, car repairs, or other urgent situations, having access to funds quickly can make a significant difference. This article will guide you through the steps of obtaining a loan in an emergency, ensuring that you receive the necessary funds promptly.

1. Assess Your Options

When facing a financial emergency, it’s crucial to assess your options before committing to a loan. Research various lenders, such as banks, credit unions, and online loan providers, to understand their terms, interest rates, and repayment plans. Compare these details to choose the most suitable option for your needs. Additionally, consider alternative sources of funding, such as borrowing from family or friends or exploring government assistance programs.

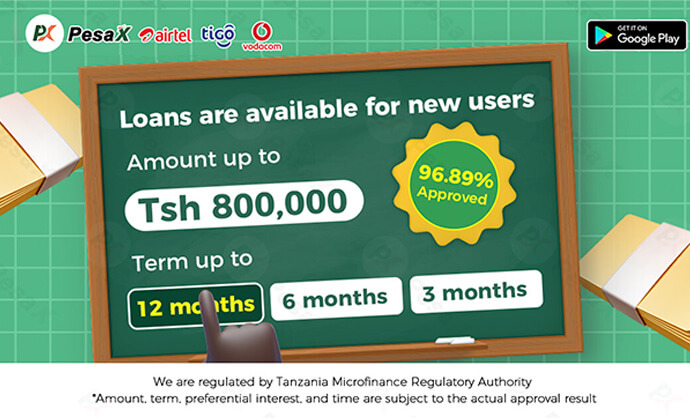

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

2. Prepare Necessary Documentation

To expedite the loan application process, gather all the necessary documentation in advance. This typically includes identification documents, proof of income, employment history, and bank statements. Having these documents readily available will save time and ensure a smooth application process.

3. Check Your Credit Score

Your credit score plays a vital role in determining loan eligibility and interest rates. Before applying for a loan, obtain a copy of your credit report and check for any errors or discrepancies. If needed, take steps to improve your credit score, such as paying off outstanding debts or resolving any issues with creditors. A higher credit score will increase your chances of approval and better loan terms.

4. Apply for the Loan

Once you have thoroughly researched your options, prepared the necessary documents, and checked your credit score, it’s time to apply for the loan. Choose the lender that best fits your requirements and complete the application process. Be honest and accurate when providing information, as any inconsistencies may lead to delays or rejection. Submit the application online or visit the lender in person, depending on their preferred method.

5. Review Terms and Conditions

Before accepting a loan offer, carefully review the terms and conditions provided by the lender. Pay close attention to the interest rate, repayment period, late payment penalties, and any additional fees. Ensure that you fully understand the obligations and responsibilities associated with the loan. If you have any questions or concerns, don’t hesitate to reach out to the lender for clarification.

6. Receive Funds and Repay the Loan

After your loan application is approved, the lender will disburse the funds according to the agreed-upon terms. The money can be deposited into your bank account, issued as a check, or transferred using a digital payment method. Once you’ve received the funds, make a repayment plan and adhere to it diligently. Timely repayments will not only help you avoid penalties but also maintain a good credit score for future financial needs.

In conclusion, obtaining a loan in an emergency requires careful consideration, thorough preparation, and diligent repayment. By assessing your options, gathering necessary documentation, checking your credit score, applying for the loan, reviewing terms and conditions, and repaying the loan promptly, you can navigate financial emergencies with confidence. Remember to borrow responsibly and only take on what you can comfortably repay.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status