How to apply for a loan online?

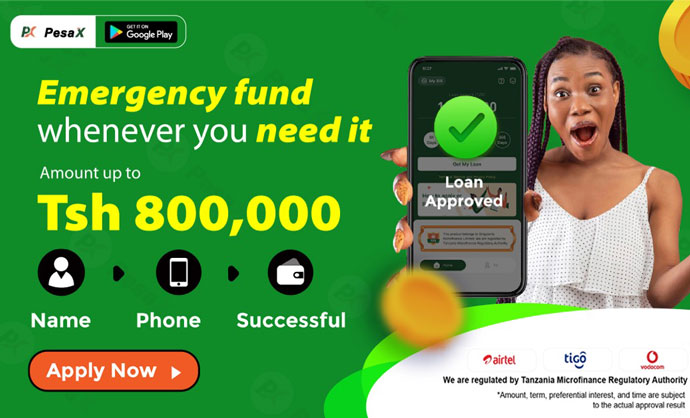

In today’s digital era, securing a loan has become more convenient than ever, thanks to online lending platforms like PesaX. PesaX offers a seamless and user-friendly interface for individuals seeking financial assistance. Here’s a comprehensive guide on how to navigate through the process and successfully apply for a loan via PesaX.

1. Registration and Account Creation: Begin by visiting the PesaX website or downloading their mobile app. Register for an account by providing essential details such as your name, contact information, email address, and creating a secure password.

2. Profile Setup and Verification: After registering, complete your profile by furnishing additional information, including your identification details, employment information, and financial history. PesaX may require documentation for verification purposes, such as identification cards, proof of income, and bank statements. Ensure all information provided is accurate and up-to-date.

3. Loan Selection and Configuration: Once your profile is verified, explore the loan options available on the platform. PesaX typically offers various loan products with different terms, interest rates, and repayment schedules. Select the loan that best suits your financial needs.

4. Application Submission: Proceed to fill out the loan application form. Provide detailed information about the loan amount required, purpose of the loan, desired repayment tenure, and any collateral (if applicable). Double-check the form for any errors before submitting it.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

5. Review and Approval Process: After submitting your application, PesaX will review the provided information and conduct an assessment of your creditworthiness. This evaluation may include analyzing your credit score, income stability, and debt-to-income ratio. The approval process duration varies, but PesaX strives to provide swift responses.

6. Loan Approval and Disbursement: Upon approval, carefully review the loan agreement terms and conditions. If you agree with the terms, electronically sign the agreement. The loan amount will then be disbursed directly into your designated bank account.

7. Repayment Structure and Monitoring: Familiarize yourself with the repayment structure outlined in the loan agreement. PesaX typically offers multiple repayment options, including monthly installments or customized schedules. Ensure timely payments to maintain a positive credit history and avoid penalties.

8. Customer Support and Assistance: Throughout your loan tenure, PesaX provides customer support to address any queries or concerns. Contact their support team via the app, website, or helpline for assistance regarding repayments, account management, or any other issues.

9. Utilize Financial Tools and Resources: Take advantage of PesaX’s financial tools and resources. These may include budgeting tools, loan calculators, and educational content to help manage your finances effectively.

10. Review and Refinancing Options: Periodically review your loan status and consider refinancing options if necessary. PesaX might offer refinancing facilities with better terms or lower interest rates based on your improved creditworthiness.

Applying for a loan online through PesaX streamlines the borrowing process, providing individuals with quick access to financial assistance. Remember, responsible borrowing practices and timely repayments are crucial for a healthy financial journey.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status