What is an online personal loan?

In the digital age, financial services are undergoing a revolution, with online personal loans becoming a high-profile innovation. This loan method is based on the Internet platform, providing a more convenient and faster lending experience, profoundly changing the traditional financial landscape. This article will delve into the definition, benefits, risks, and importance of online personal loans in modern society.

1. Definition

Online personal loan is a loan activity completed through the Internet platform. Compared with traditional loans, it is simpler and more efficient. With online personal loans, borrowers can complete the entire loan application, approval and disbursement process electronically without leaving their homes. This loan method is usually provided by professional online loan platforms and covers a variety of loan products, such as short-term loans, installment loans, credit loans, etc.

2. Advantages

The popularity of online personal loans cannot be separated from its many advantages. First of all, convenience is its most significant feature. Borrowers do not need to go to a bank or other financial institution to apply for a loan. Everything can be done at home through electronic devices. This greatly saves time and effort, providing an effective solution to urgent needs.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

Secondly, fast approval is also a big advantage of online personal loans. Traditional loans often require cumbersome review procedures and take a long time. Online personal loan platforms usually use advanced risk assessment technology to complete borrowers’ credit assessment and application approval in a short period of time, allowing borrowers to obtain the funds they need more quickly.

Additionally, the flexibility of online personal loans is worth mentioning. Borrowers can choose different repayment methods and terms according to personal needs to meet personalized financial needs. This flexibility can help improve borrowers’ repayment capabilities and reduce repayment pressure.

3. Risks

However, despite the conveniences that come with online personal loans, they also come with certain risks. First and foremost is the issue of information security. During the loan process, borrowers need to provide sensitive personal information, such as ID numbers, bank accounts, etc. Once leaked, it may lead to identity theft and financial losses. Therefore, when choosing an online personal loan platform, borrowers should choose a reputable and secure platform and strengthen their awareness of information protection.

Additionally, high interest rates are a potential risk with online personal loans. Since online personal loan platforms usually cater to riskier groups, their interest rates may be relatively high in order to hedge risks. Borrowers should carefully compare interest rates on different platforms when choosing a loan, and ensure that they have the ability to repay on time to avoid falling into the trap of loan sharking.

4. Importance in modern society

With the development of society and the acceleration of the pace of life, people’s demand for financial services has become more and more urgent. Online personal loans cater to this demand with their convenience and speed, and have become one of the indispensable financial tools in modern society.

First, it provides a timely solution for people with urgent financial needs. Whether it is unexpected medical expenses, emergency repair expenses or other emergencies, online personal loans can meet the borrower’s financial needs in the shortest time and provide protection for life.

Secondly, online personal loans provide an avenue for those with poor credit histories to obtain traditional loans. Through advanced risk assessment technology, these platforms are able to more comprehensively assess a borrower’s repayment ability, providing borrowing opportunities for those with poor credit records.

Finally, the flexibility of online personal loans makes them an ideal option for people with special financial needs. Borrowers can choose different repayment methods and terms according to their actual situation to better adapt to their personal financial situation.

in conclusion

As one of the innovations in the modern financial field, online personal loans meet people’s diverse financial needs with its convenience and speed. However, borrowers still need to remain cautious and rational when utilizing this convenient tool, choose a reputable platform, and have a clear understanding of their repayment ability. With the joint efforts of both parties, online personal loans will better serve society and provide support for individual and socioeconomic development.

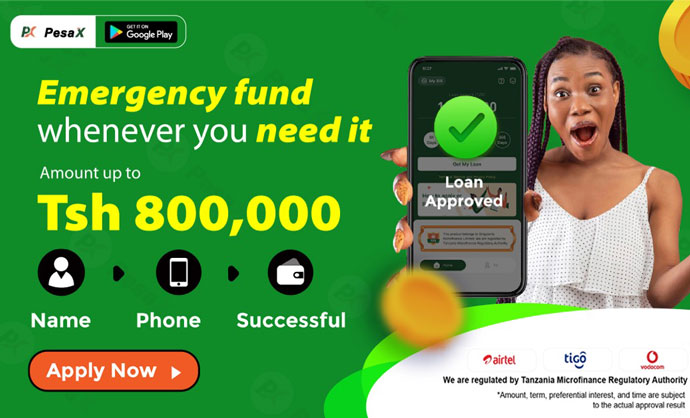

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status