What are the pros and cons of online personal loans?

In the rapidly evolving landscape of personal finance, online personal loans have emerged as a popular choice for individuals seeking quick and convenient access to funds. This article will delve into the pros and cons of online personal loans, providing a comprehensive overview of the advantages and potential drawbacks associated with this modern financial tool.

Pros of Online Personal Loans:

-

Convenience and Accessibility:

-

Pros: One of the most significant advantages of online personal loans is the convenience they offer. Borrowers can apply for loans from the comfort of their homes, eliminating the need for physical visits to banks or financial institutions.

-

Pros: The online application process is accessible 24/7, allowing borrowers to submit applications at their convenience, even outside traditional banking hours.

-

Quick Approval and Disbursement:

-

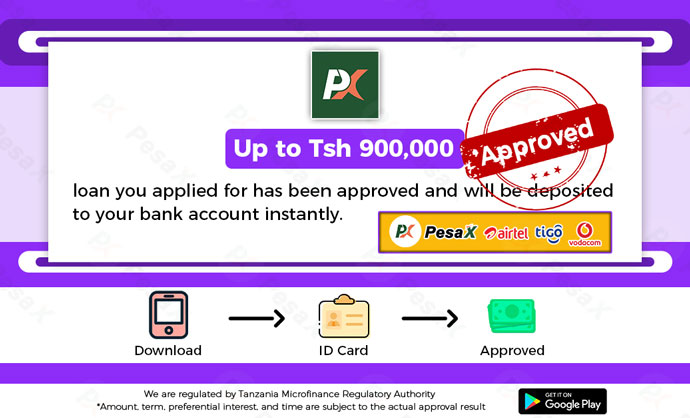

Pros: Online lenders often employ advanced algorithms and technology for swift application processing and approval. This results in faster approval times compared to traditional loan processes.

-

Pros: Once approved, funds are typically disbursed quickly, addressing urgent financial needs and emergencies.

-

Flexible Loan Options:

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

-

Pros: Online personal loan platforms usually offer a range of loan products with varying terms and conditions. Borrowers can choose loan amounts, repayment periods, and interest rates that align with their financial preferences.

-

Pros: The flexibility in loan options caters to diverse financial needs, from short-term cash flow issues to more extended repayment plans.

-

Paperless Application Process:

-

Pros: Online personal loans often involve a paperless application process, reducing the need for extensive documentation. Borrowers can upload necessary documents electronically, streamlining the entire process.

-

Credit Score Improvement:

-

Pros: Timely repayment of online personal loans can contribute positively to a borrower’s credit score. This can be beneficial for individuals looking to build or repair their credit history.

Cons of Online Personal Loans:

-

Higher Interest Rates:

-

Cons: One of the main drawbacks of online personal loans is that they may come with higher interest rates compared to traditional loans. This is often due to the perceived risk associated with online lending.

-

Potential for Predatory Lending:

-

Cons: The online lending space is not immune to predatory practices. Some lenders may take advantage of vulnerable borrowers by offering loans with exorbitant interest rates and hidden fees. Borrowers should exercise caution and thoroughly research lenders before committing to a loan.

-

Limited Face-to-Face Interaction:

-

Cons: Unlike traditional banks, online lenders lack the physical presence for face-to-face interactions. This can be a disadvantage for individuals who prefer or require personalized assistance in understanding loan terms or resolving issues.

-

Security and Privacy Concerns:

-

Cons: Transmitting personal and financial information online raises security and privacy concerns. Borrowers need to ensure that the online platforms they use adhere to robust security measures to protect sensitive data.

-

Potential for Overborrowing:

-

Cons: The ease of online loan applications may lead to a temptation to overborrow. Borrowers should carefully assess their financial needs and repayment capabilities to avoid taking on more debt than necessary.

-

Variable Regulation:

-

Cons: The online lending industry is subject to varying degrees of regulation in different regions. This lack of uniformity can result in inconsistent consumer protection standards, making it crucial for borrowers to be aware of the regulatory environment in their jurisdiction.

Conclusion:

Online personal loans offer a convenient and efficient solution to the evolving financial needs of individuals. While the advantages include accessibility, speed, and flexibility, borrowers must navigate potential pitfalls such as higher interest rates and security concerns. Making informed decisions, conducting thorough research, and understanding the terms and conditions are crucial steps for individuals considering online personal loans. Ultimately, the key lies in leveraging the benefits while mitigating the risks associated with this contemporary financial tool.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status