Is Pesax’s personal loan review process fast?

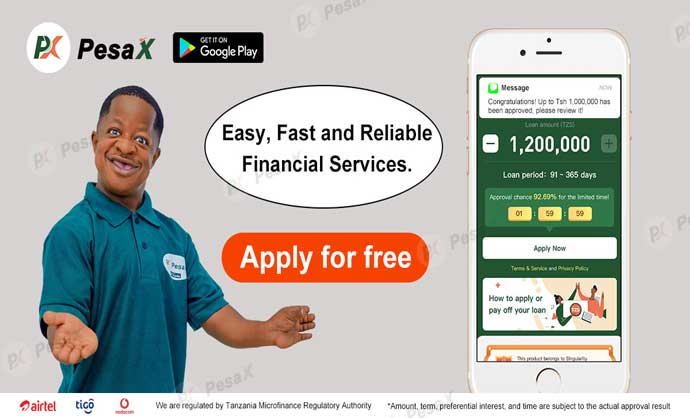

In the realm of personal finance, the speed at which a loan application is reviewed and approved is a crucial factor for individuals seeking quick access to funds. Pesax, as a platform offering personal loans, has garnered attention for its promise of convenience and efficiency. In this comprehensive article, we will delve into the intricacies of Pesax’s personal loan review process, exploring its speed, efficiency, and the factors that contribute to a swift outcome.

Understanding Pesax’s Personal Loan Review Process:

-

Digital Advancements:

-

Pesax leverages digital technologies to streamline its personal loan review process. Automated algorithms and advanced data analysis contribute to a more efficient assessment of applicants’ creditworthiness, income stability, and overall financial health.

-

Online Application Convenience:

-

The initial step in Pesax’s personal loan journey is the online application process. This digital approach enhances convenience for applicants, allowing them to submit their details and required documents seamlessly from the comfort of their homes.

-

Document Verification:

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

-

Pesax employs digital document verification processes to expedite the review. Applicants are typically required to upload necessary documents digitally, and the platform’s algorithms assess the authenticity and completeness of the provided information.

-

Credit Scoring:

-

Pesax often utilizes credit scoring models to assess the creditworthiness of applicants. These models consider factors such as credit history, outstanding debts, and repayment patterns. The automated nature of credit scoring contributes to a faster and more consistent review process.

-

Algorithmic Risk Assessment:

-

Pesax employs algorithmic risk assessment models to evaluate the potential risks associated with lending to an individual. These algorithms analyze various data points to gauge the applicant’s ability to repay the loan, contributing to a more nuanced and efficient risk evaluation.

-

Real-time Decisioning:

-

Pesax’s commitment to efficiency is often reflected in real-time decisioning. Once an applicant submits their information, the platform’s algorithms work swiftly to provide a decision on the loan application, reducing the waiting period for borrowers.

-

Communication Channels:

-

Pesax typically communicates with applicants through digital channels, providing updates on the status of their loan applications. This proactive communication enhances transparency and keeps applicants informed throughout the review process.

Factors Influencing Speed:

-

Completeness of Application:

-

The speed of Pesax’s personal loan review process can be influenced by the completeness of the application. Applicants are advised to provide all required information and documents accurately to avoid delays.

-

Creditworthiness:

-

Applicants with strong credit histories and favorable financial profiles may experience faster processing times. A positive credit history often expedites the approval process and contributes to a quicker review.

-

Loan Amount and Terms:

-

The specific loan amount and repayment terms selected by the applicant can impact the review process. Smaller loan amounts and more straightforward terms may undergo quicker assessments.

-

System Efficiency:

-

Pesax’s system efficiency, including the reliability of its digital infrastructure and algorithms, plays a significant role in the speed of the review process. Continuous improvements in these systems contribute to faster decision-making.

Pesax’s personal loan review process is designed to be efficient and swift, leveraging digital advancements to streamline the traditional lending journey. The platform’s commitment to providing quick financial solutions aligns with the expectations of individuals seeking timely access to funds. As with any financial decision, applicants are encouraged to thoroughly understand Pesax’s terms, policies, and repayment conditions before initiating the loan application process. By doing so, individuals can navigate the financial landscape with confidence, knowing that Pesax prioritizes both speed and reliability in its personal loan review process.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status