Do I need to provide collateral to apply for a personal loan with PesaX?

In the realm of personal finance, PesaX has emerged as a prominent player, offering individuals access to convenient and flexible personal loans. One of the common queries that potential borrowers often have is whether collateral is required for a personal loan application with pesax. In this comprehensive article, we will delve into the intricacies of PesaX’s personal loan offerings, shedding light on whether collateral is a prerequisite and exploring the nuances of the lending process.

Understanding Personal Loans at PesaX:

-

Collateral-Free Convenience:

-

PesaX is known for providing unsecured personal loans, meaning that borrowers typically do not need to provide collateral to secure the loan. Unsecured loans are granted based on the borrower’s creditworthiness, financial stability, and repayment capacity.

-

Creditworthiness Assessment:

-

PesaX employs a thorough creditworthiness assessment as a key determinant in the loan approval process. This assessment often includes a review of the borrower’s credit history, income stability, and other financial indicators.

-

No Physical Assets Required:

Online Credit Loans

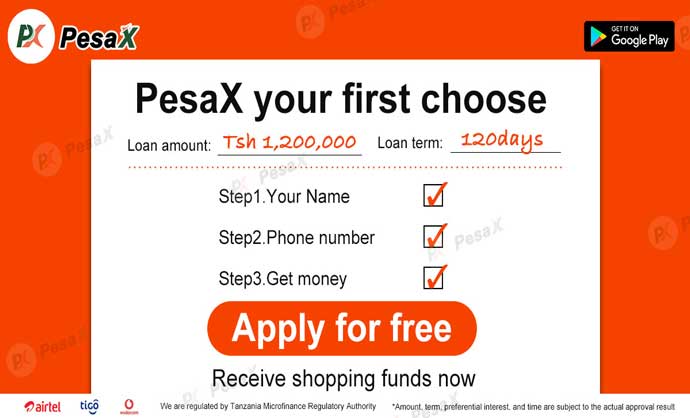

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

-

Unlike secured loans that necessitate the provision of physical assets (such as property or vehicles) as collateral, PesaX’s personal loans are designed to be accessible without such requirements. This enhances the convenience and accessibility of the borrowing process.

-

Emphasis on Financial Stability:

-

PesaX places a significant emphasis on evaluating the financial stability of applicants. A stable income, a positive credit history, and responsible financial behavior are factors that contribute to a favorable assessment.

-

Flexible Use of Funds:

-

Unsecured personal loans from PesaX offer borrowers the flexibility to use the funds for various purposes, including debt consolidation, emergencies, education, or any other personal financial need.

Factors Influencing Loan Approval:

-

Credit Score:

-

A higher credit score generally increases the likelihood of loan approval. PesaX considers the applicant’s credit score as a reflection of their creditworthiness and financial responsibility.

-

Income Stability:

-

Demonstrating a stable and regular source of income is crucial. PesaX assesses the borrower’s ability to repay the loan based on their income and financial stability.

-

Debt-to-Income Ratio:

-

PesaX may evaluate the borrower’s debt-to-income ratio, which is the proportion of monthly income dedicated to debt repayment. A reasonable debt-to-income ratio enhances the borrower’s repayment capacity.

-

Loan Amount and Terms:

-

The specific loan amount and repayment terms selected by the borrower can influence the approval process. PesaX typically considers the borrower’s preferences while ensuring responsible lending practices.

-

Documentation Accuracy:

-

Providing accurate and complete documentation is essential for a smooth application process. Ensuring that all required documents are submitted correctly can expedite the loan approval process.

The PesaX Borrowing Experience:

-

Online Application Process:

-

PesaX offers a user-friendly online application process, allowing borrowers to conveniently submit their loan applications from the comfort of their homes.

-

Transparent Terms and Conditions:

-

PesaX is committed to transparency in its lending practices. Borrowers are encouraged to review the terms and conditions, including interest rates and repayment schedules, to make informed borrowing decisions.

-

Communication Channels:

-

PesaX maintains clear communication channels with borrowers throughout the application process. Regular updates on the status of the loan application and any additional requirements are communicated promptly.

Conclusion:

In conclusion, PesaX’s personal loans are designed to provide borrowers with a hassle-free and collateral-free borrowing experience. The emphasis on creditworthiness, financial stability, and responsible lending practices positions PesaX as a platform that prioritizes accessibility and convenience. As with any financial decision, potential borrowers are encouraged to thoroughly review PesaX’s terms and conditions and assess their own financial capabilities before initiating a personal loan application. With PesaX’s commitment to providing transparent and efficient lending solutions, individuals can navigate their financial needs with confidence and ease.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status