Are pesax loan interest rates high?

In the dynamic landscape of personal finance, the interest rates attached to loans are pivotal factors that influence the borrowing experience. For those exploring financial solutions, Pesax stands out as a platform offering diverse loan products, including personal loans, with a notable feature — low-interest rates. This comprehensive article aims to unravel the intricacies of Pesax loan interest rates, exploring the factors contributing to their affordability, comparing them to industry benchmarks, and providing insights for borrowers seeking a financially prudent path.

Understanding Pesax’s Commitment to Low-Interest Financing:

-

Introduction to Pesax’s Vision:

-

Pesax is more than just a financial platform; it’s a proponent of accessible and transparent financial solutions. At the heart of Pesax’s vision is the commitment to offering low-interest financing, providing individuals with cost-effective borrowing options.

-

Low-Interest Rates as a Cornerstone:

-

Low-interest rates are a cornerstone of Pesax’s lending philosophy. They play a crucial role in making loans affordable, reducing the financial burden on borrowers, and fostering a positive borrowing experience. Understanding how Pesax aligns its interest rates with this philosophy sets the stage for evaluating the affordability of its loans.

Factors Contributing to Low-Interest Financing with Pesax:

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

-

Creditworthiness and Favorable Rates:

-

Pesax may offer personalized interest rates based on the creditworthiness of individual borrowers. Those with strong credit profiles often benefit from more favorable rates, aligning with Pesax’s objective of providing accessible and affordable financing to a broad spectrum of borrowers.

-

Flexible Loan Amounts and Repayment Terms:

-

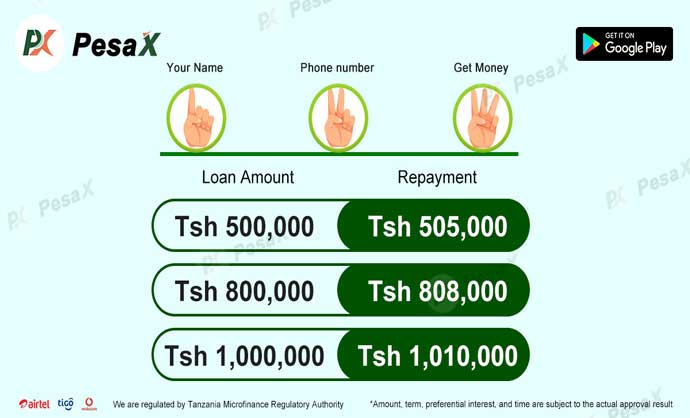

The flexibility offered by Pesax in terms of loan amounts and repayment terms contributes to low-interest financing. Borrowers have the freedom to tailor their loans to suit their financial needs, and Pesax adjusts interest rates accordingly, ensuring affordability and customization.

-

Transparency as a Foundation:

-

Transparency is a foundational principle for Pesax. Clear communication about interest rates, associated fees, and the overall cost of borrowing establishes trust with borrowers. Pesax’s commitment to transparency enables individuals to make well-informed decisions, knowing the true cost of their loans.

Comparing Pesax Rates to Industry Standards:

-

Exceeding Industry Averages:

-

To assess the true value of Pesax’s low-interest rates, a comparison with industry averages is crucial. Pesax’s rates are positioned not just to meet industry standards but to exceed them, offering borrowers a competitive edge in the realm of affordable financing.

-

Regional Variances and Competitive Edge:

-

Understanding regional variations in interest rates provides context to Pesax’s competitive edge. By offering low-interest rates that outshine regional norms, Pesax becomes a beacon for borrowers seeking not just loans but financially prudent solutions.

Borrower Experiences: A Testimony to Low-Interest Financing:

-

Real-World Accounts of Affordability:

-

Borrower testimonials offer real-world accounts of the affordability of Pesax loans. Examining experiences shared by individuals who have benefited from low-interest financing provides insights into how Pesax’s commitment translates into tangible financial advantages for borrowers.

-

Customer Satisfaction Metrics:

-

Customer satisfaction metrics, including feedback on interest rates, provide a quantitative measure of Pesax’s success in delivering low-interest financing. High satisfaction levels underscore the positive impact of Pesax’s approach on borrowers’ financial well-being.

Empowering Borrowers on a Financially Prudent Path:

-

Aligning with Individual Financial Goals:

-

Pesax’s low-interest rates empower borrowers to align their borrowing decisions with individual financial goals. Whether it’s debt consolidation, home improvement, or unexpected expenses, Pesax provides a pathway for borrowers to achieve their objectives with financial prudence.

-

Holistic Evaluation of Loan Packages:

-

Beyond low-interest rates, Pesax encourages borrowers to undertake a holistic evaluation of its loan packages. Considerations such as repayment flexibility, additional features, and the overall borrowing experience contribute to a well-rounded assessment of the value Pesax brings to borrowers.

In conclusion, Pesax’s commitment to low-interest financing transcends the conventional lending landscape. By understanding the factors contributing to low-interest rates, comparing them to industry benchmarks, and delving into real-world borrower experiences, individuals can appreciate Pesax’s role as a provider of not just loans but as a facilitator of sound financial decisions. Pesax’s dedication to affordability positions it as a catalyst for borrowers seeking a financially prudent path, where low-interest rates become more than a feature—they become a cornerstone of financial empowerment.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status