How to get a personal loan in PesaX in 5 minutes?

In the fast-paced realm of financial technology, the ability to secure a personal loan swiftly has become a transformative aspect of the lending landscape. PesaX, a dynamic financial platform, has taken center stage by offering users the opportunity to obtain a personal loan in just 5 minutes. This comprehensive article explores the intricacies of the process, the advantages, and the considerations involved in obtaining a personal loan with unprecedented speed, shedding light on how PesaX has redefined the borrowing experience.

The Need for Speed in Personal Loans:

-

Urgency in Financial Requirements:

-

Life is characterized by unpredictability, and financial needs often arise with little warning. Whether it’s an unexpected medical expense or seizing a time-sensitive opportunity, the ability to secure a personal loan swiftly is paramount.

-

Evolution of Lending:

-

The article delves into the historical context of lending, emphasizing how traditional methods often involved lengthy processes. It introduces the transformative impact of financial technology, especially platforms like PesaX, in revolutionizing the speed at which loans are processed and approved.

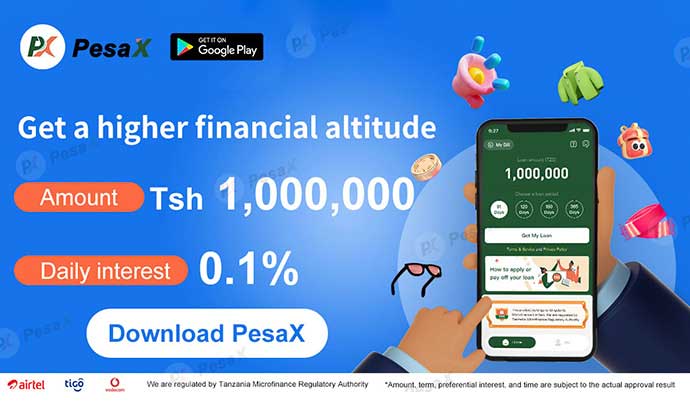

PesaX: Revolutionizing the Borrowing Experience:

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

-

User-Friendly Interface:

-

PesaX’s commitment to user satisfaction is highlighted, starting with its user-friendly interface. The article explores how the platform has streamlined the application process, ensuring that users can navigate through the necessary steps effortlessly.

-

Real-Time Approval:

-

A pivotal feature of PesaX is its real-time approval system. The article explains how PesaX utilizes advanced algorithms and data analysis to assess loan applications promptly, providing users with instant feedback on their eligibility.

-

No Collateral Requirements:

-

PesaX’s departure from traditional collateral requirements is explored. Borrowers can secure loans without the need to pledge assets, making the process not only rapid but also more accessible to a broader range of individuals.

Navigating the Borrowing Process with PesaX:

-

Initiating the Application:

-

The step-by-step process of initiating a loan application with PesaX is detailed. Borrowers can learn how to input necessary information seamlessly, ensuring a smooth start to their borrowing journey.

-

Real-Time Evaluation:

-

The article provides insights into PesaX’s real-time evaluation mechanism. Borrowers can understand how the platform assesses their eligibility promptly, offering transparency and efficiency in the lending process.

Considerations for Borrowers:

-

Understanding Terms and Conditions:

-

While speed is essential, the article emphasizes the importance of borrowers understanding the terms and conditions of the loan. It provides guidance on interest rates, fees, and repayment schedules to ensure informed decision-making.

-

Responsible Borrowing:

-

Borrowers are reminded of the significance of responsible borrowing. The article explores how individuals can assess their financial needs accurately, borrow within their means, and utilize funds responsibly to avoid potential pitfalls.

Technology and Security Measures:

-

Advanced Technological Integration:

-

The article highlights PesaX’s incorporation of advanced technology to expedite the borrowing process. It explores how technology ensures not only speed but also accuracy and security in evaluating loan applications.

-

Security Protocols:

-

PesaX’s commitment to ensuring the security of user data and financial transactions is underscored. The article details the security protocols in place, addressing potential concerns and instilling confidence in users.

Future Trends and Innovations:

-

Continued Technological Advancements:

-

The article speculates on the future of rapid personal loans, considering potential technological advancements and innovations that could further enhance the speed, accessibility, and efficiency of the lending process through platforms like PesaX.

-

Enhancements in User Experience:

-

As technology evolves, the article explores how future enhancements in user experience could contribute to an even more seamless borrowing journey for individuals.

In conclusion, PesaX emerges as a pioneer in redefining the borrowing experience by offering a rapid and efficient process for obtaining personal loans. The platform’s user-friendly interface, real-time approval, and commitment to transparency set a new standard in the financial technology landscape. When time is of the essence, PesaX stands as a reliable partner, providing users with the means to address their financial needs promptly and seamlessly. As technology continues to advance, PesaX remains at the forefront of innovative lending solutions, offering a glimpse into the future of rapid personal loans.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status