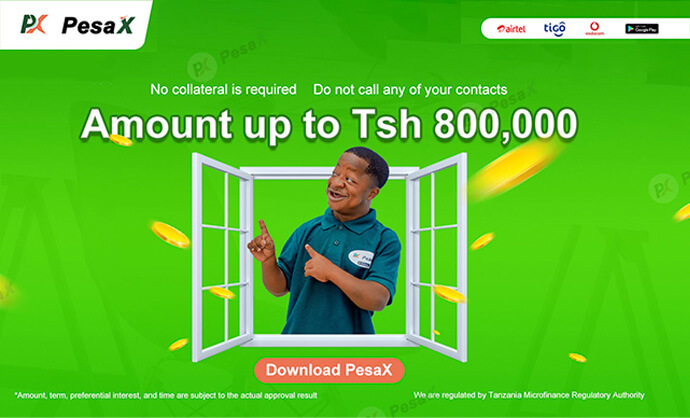

PesaX – Tanzania’s premier unsecured quick loan platform

In the dynamic landscape of financial services, PesaX emerges as Tanzania’s premier platform for unsecured quick loans, redefining the way individuals access financial resources with speed and convenience. This comprehensive article explores the key features and benefits that make PesaX a leader in the realm of unsecured quick loans, emphasizing its commitment to empowering Tanzanians on their financial journeys.

1. Introduction to PesaX:

The article kicks off with an introduction to PesaX, highlighting its status as the premier platform for unsecured quick loans in Tanzania. Readers gain insights into the platform’s vision and commitment to transforming financial accessibility.

2. Unsecured Quick Loans Defined:

Delving into the concept of unsecured quick loans, the article provides clarity on what distinguishes PesaX in offering financial solutions without the need for collateral, ensuring a seamless borrowing experience.

3. PesaX’s Commitment to Speed:

One of PesaX’s standout features is its commitment to speed. The article explores how the platform expedites the loan application and approval process, ensuring users get the financial assistance they need without unnecessary delays.

4. User-Friendly Interface:

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

Navigating through PesaX’s user-friendly interface is crucial for a positive experience. The article provides a walkthrough of the platform’s design, emphasizing its intuitive features for quick and easy navigation.

5. Creating an Account on PesaX:

A step-by-step guide is offered on creating an account on PesaX, ensuring that users can swiftly onboard and initiate the process of obtaining unsecured quick loans tailored to their financial needs.

6. Real-Time Evaluation and Approval:

PesaX’s real-time evaluation process is a game-changer. The article explains how this feature ensures users receive prompt responses regarding their eligibility and approval status, making the loan application process efficient.

7. Customizing Repayment Plans:

Personalization is key on PesaX. The article explores how users can customize their repayment plans, tailoring the terms to align with their specific financial situations and ensuring a stress-free repayment process.

8. Instant Disbursement of Funds:

The article emphasizes the speed of fund disbursement with PesaX, ensuring that once the loan is approved, users can access the funds instantly to address their financial needs.

9. Security Measures for Loan Transactions:

Security is a top priority in financial transactions. The article discusses the robust security measures implemented by PesaX, assuring users that their sensitive information is safeguarded.

10. PesaX’s Impact on Financial Inclusion:

The article concludes by highlighting PesaX’s broader impact on financial inclusion in Tanzania. By providing unsecured quick loans, the platform plays a pivotal role in democratizing access to financial resources.

11. User Testimonials and Success Stories:

Integrating user testimonials and success stories adds a personal touch to the article, allowing readers to understand the real-life impact of PesaX on individuals’ financial journeys.

12.PesaX – A Catalyst for Financial Empowerment:

In conclusion, the article reiterates PesaX’s role as a catalyst for financial empowerment in Tanzania. By offering premier unsecured quick loans, PesaX stands at the forefront of transforming how Tanzanians navigate their financial landscapes, fostering a culture of financial freedom and accessibility.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status