Are the interest rates and fees for pesax loans in Tanzania reasonable?

Pesax, a prominent financial technology company in Tanzania, offers instant loans and personal loan services through its mobile application. As users seek financial solutions, one critical aspect to consider is the reasonableness of interest rates and fees associated with Pesax loans.

Understanding Pesax Loan Structure:

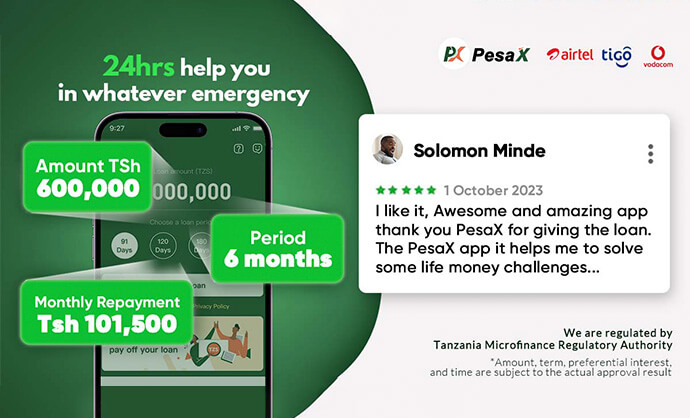

Pesax provides users with a convenient platform to apply for loans, facilitating swift access to much-needed funds. The application process is user-friendly, ensuring a seamless experience for borrowers. The company’s commitment to transparency is evident in its straightforward loan structures and flexible repayment plans.

Interest Rates:

One of the primary considerations for borrowers is the interest rates imposed on loans. Pesax aims to strike a balance between providing accessible financial assistance and maintaining reasonable interest rates. The interest rates are competitive within the Tanzanian market, reflecting the company’s dedication to offering fair and equitable financial solutions.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

Fee Structure:

In addition to interest rates, understanding the fee structure is crucial for borrowers. Pesax ensures transparency by clearly outlining any associated fees. While fees may vary based on the type and amount of the loan, Pesax strives to keep these charges reasonable, allowing borrowers to make informed decisions without unexpected financial burdens.

Regulatory Compliance:

Pesax operates within the regulatory framework of Tanzania’s financial sector. Compliance with relevant regulations is crucial for ensuring that the company’s practices align with industry standards and protect the interests of borrowers. By adhering to regulatory guidelines, Pesax demonstrates its commitment to ethical lending practices.

Customer Experience:

The overall customer experience plays a vital role in assessing the reasonableness of interest rates and fees. Pesax’s dedication to customer satisfaction is reflected in its user-friendly app, responsive customer support, and clear communication regarding loan terms. A positive customer experience contributes to the perception of the overall value provided by Pesax.

Comparative Analysis:

To determine the reasonableness of Pesax’s interest rates and fees, it’s essential to compare them with industry benchmarks and competitors. An analysis of the financial landscape in Tanzania allows borrowers to assess Pesax’s offerings in relation to other available options, ensuring they make informed financial decisions.

Financial Education Initiatives:

Pesax goes beyond loan provision by actively promoting financial education. By empowering borrowers with knowledge about responsible financial management, Pesax aims to enhance financial literacy and promote a healthy borrowing mindset. This commitment to education contributes to the reasonableness of the company’s services.

In conclusion, Pesax’s approach to interest rates and fees demonstrates a commitment to providing reasonable and transparent financial solutions to its users in Tanzania. The company’s adherence to regulatory standards, focus on customer experience, and initiatives in financial education collectively contribute to the overall reasonableness of Pesax loans. Borrowers are encouraged to assess their individual financial needs and compare options to make well-informed decisions when considering Pesax for their lending requirements.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status