How is the safety and reliability of pesax online loans in Tanzania guaranteed?

As the financial technology sector continues to evolve, the safety and reliability of online loan platforms become paramount for users. This article explores the measures taken by Pesax, a prominent financial technology company in Tanzania, to guarantee the safety and reliability of its online loans. Examining security protocols, reliability factors, and risk mitigation strategies offers potential borrowers valuable insights into the platform’s commitment to a secure and trustworthy lending environment.

Secure Data Transmission and Storage:

Pesax typically employs industry-standard encryption protocols to secure the transmission of sensitive user data. This ensures that personal and financial information shared during the loan application process is safeguarded from unauthorized access. Additionally, robust data storage practices contribute to protecting user information throughout the loan lifecycle.

Compliance with Regulatory Standards:

A key element of ensuring safety and reliability in the financial sector is compliance with regulatory standards. Pesax operates within the regulatory framework of Tanzania, adhering to guidelines set by relevant authorities. This commitment demonstrates the platform’s dedication to ethical lending practices and user protection.

Fraud Prevention Measures:

Pesax often integrates advanced fraud prevention measures to identify and mitigate potential risks. This includes the use of sophisticated algorithms and artificial intelligence to detect unusual patterns or suspicious activities. By actively addressing fraud risks, Pesax enhances the overall safety of its online lending platform.

Transparent Terms and Conditions:

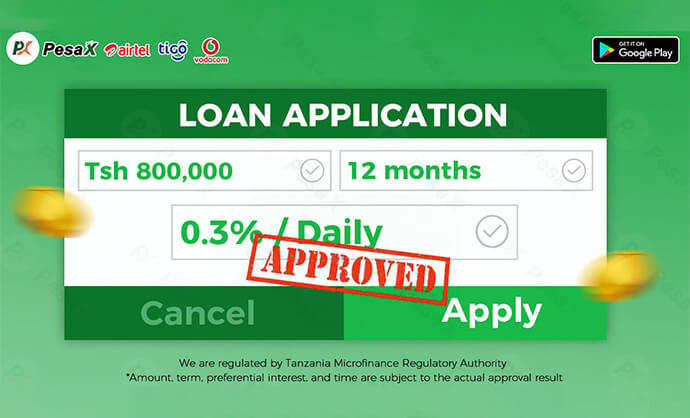

Reliability is closely tied to transparency in the terms and conditions of loans. Pesax typically provides clear and understandable terms, including interest rates, fees, and repayment schedules. Transparent communication ensures that borrowers are well-informed about the financial commitment they are undertaking.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

User Authentication and Verification:

To prevent unauthorized access and identity theft, Pesax often implements robust user authentication and verification processes. This involves multi-factor authentication methods and verification of user identities to ensure that only authorized individuals can access and manage loan accounts.

Customer Education on Online Security:

Pesax typically takes a proactive approach to enhance user awareness of online security. The platform may provide educational resources and tips on safe online practices, empowering users to play an active role in safeguarding their personal and financial information.

Continuous Monitoring and Adaptation:

The digital landscape is dynamic, and potential risks are ever-evolving. Pesax typically employs continuous monitoring mechanisms to stay vigilant against emerging threats. Regular assessments of security protocols and adaptation to industry best practices contribute to the ongoing safety and reliability of the online lending platform.

Reliable Customer Support:

A reliable customer support system is a crucial component of ensuring user confidence. Pesax usually offers accessible and responsive customer support channels to assist users with any security-related concerns, technical issues, or inquiries. This commitment to customer assistance reinforces the platform’s reliability.

User Reviews and Feedback:

User reviews and feedback serve as valuable indicators of the safety and reliability of online lending platforms. Positive reviews often highlight a platform’s security measures and the reliability of its services. Pesax may actively seek and consider user feedback to make continuous improvements and address any concerns raised by its user community.

The safety and reliability of Pesax online loans in Tanzania are typically ensured through a comprehensive approach that encompasses data security, regulatory compliance, fraud prevention, transparency, user authentication, continuous monitoring, customer education, and reliable customer support. As potential borrowers evaluate online lending platforms, understanding these aspects can empower them to make informed decisions that align with their preferences and priorities for a secure and reliable financial experience.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status