What is the loan amount range for pesax in Tanzania?

Pesax, a leading financial technology company in Tanzania, offers a range of loan products to address diverse financial needs. This article delves into the loan amount range provided by Pesax in Tanzania, with a specific focus on the notable amount of TZS 1,200,000. Understanding the loan amount offerings is crucial for potential borrowers seeking financial assistance and allows them to evaluate how Pesax aligns with their specific requirements.

Customized Loan Amounts:

Pesax typically adopts a customer-centric approach by providing customized loan amounts based on individual financial profiles. While there may be a set range, the platform often assesses the borrower’s financial situation, repayment capability, and other factors to determine the most suitable loan amount.

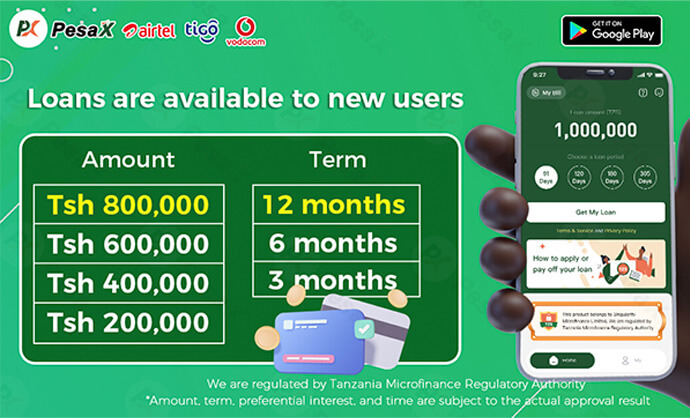

Range of Loan Amounts:

The loan amount range offered by Pesax can vary, accommodating a spectrum of financial needs. While smaller amounts may be suitable for short-term and immediate expenses, larger amounts, such as TZS 1,200,000, can cater to more substantial financial requirements. This flexibility allows Pesax to serve a broad user base with diverse financial goals.

TZS 1,200,000: A Notable Option:

TZS 1,200,000 is a notable loan amount that may address various financial scenarios. This amount could be sought for purposes such as medical emergencies, education expenses, home improvements, or debt consolidation. Pesax’s inclusion of this specific amount in its offerings reflects an understanding of the common financial needs of its users.

Financial Assessment for Loan Approval:

While TZS 1,200,000 is a substantial loan amount, Pesax typically conducts a thorough financial assessment before approving loans. This assessment considers factors such as income, employment stability, and credit history to ensure that borrowers have the capacity to repay the loan responsibly.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

Transparency in Loan Terms:

Pesax is known for its commitment to transparency, and this extends to the communication of loan terms, including amounts, interest rates, and repayment schedules. This transparency empowers borrowers to make informed decisions, understanding the full scope of their financial commitments.

Gradual Increase in Loan Limits:

As borrowers demonstrate responsible repayment behavior, Pesax may offer the opportunity for a gradual increase in loan limits. This approach rewards responsible financial behavior and allows users to access higher loan amounts over time, aligning with their evolving financial needs.

Accessibility and Inclusivity:

Pesax’s loan amount offerings reflect a commitment to financial accessibility and inclusivity. By providing a range of loan amounts, including options like TZS 1,200,000, the platform ensures that individuals from various financial backgrounds can access the funds they need to navigate life’s challenges.

User-Friendly Application Process:

Applying for a loan with Pesax is typically a user-friendly experience. The mobile application guides users through the application process, allowing them to input their desired loan amount, understand the associated terms, and submit the necessary documentation efficiently.

Responsive Customer Support:

For users considering TZS 1,200,000 or other loan amounts, Pesax’s responsive customer support is a valuable resource. The support team can provide clarification on loan terms, assist with the application process, and address any inquiries related to the loan amount and repayment.

Pesax’s loan amount offerings in Tanzania, including the notable option of TZS 1,200,000, reflect a commitment to meeting the diverse financial needs of its user base. Through a combination of flexibility, transparency, and customer-centric practices, Pesax aims to empower individuals to access the right amount of financial assistance to achieve their goals. As potential borrowers explore loan options, understanding Pesax’s approach to loan amounts enhances their ability to make informed and suitable financial decisions.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status