What are the application conditions and process for Pesax online loans?

Pesax online loans provide a convenient way for individuals to access financial assistance. This article will delve into the application conditions and process for obtaining a Pesax online loan, providing a comprehensive guide for those seeking this type of financial support.

Eligibility Requirements

To apply for a Pesax online loan, individuals must meet certain eligibility criteria. Applicants are typically required to be of legal age, have a stable source of income, and possess a valid identification document. Additionally, some lenders may have specific credit score requirements that applicants must meet in order to qualify for a loan. It’s important for potential borrowers to review and understand these eligibility requirements before initiating the application process.

Online Credit Loans

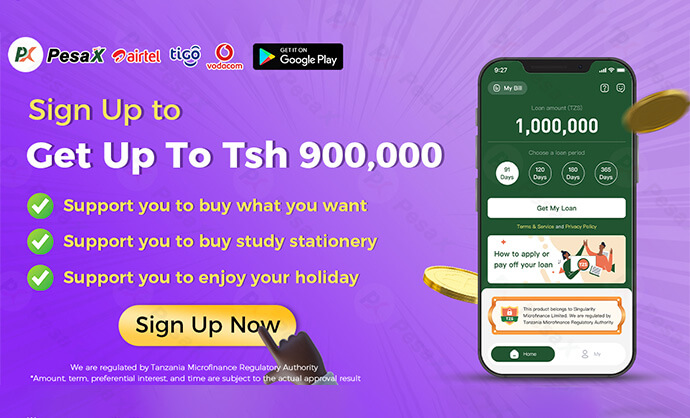

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

Application Process

The application process for a Pesax online loan is designed to be straightforward and user-friendly. Prospective borrowers can visit the Pesax website or utilize the Pesax mobile app to initiate the application. They will be required to provide personal information, including their full name, contact details, employment status, income details, and any other information deemed necessary by the lender.

Evaluation and Approval

Once the application is submitted, the lender will evaluate the information provided by the applicant. This may include verifying the individual’s income and conducting a credit assessment. The approval decision is typically communicated to the applicant within a short period of time. If approved, the borrower will receive details regarding the loan amount, interest rate, repayment terms, and any associated fees.

Loan Disbursement

Upon acceptance of the loan terms, the funds are disbursed to the borrower. The method of disbursement may vary, but it is commonly done through direct deposit into the borrower’s bank account. Some lenders may offer alternative disbursement options to accommodate the preferences of their customers.

Repayment Structure

Pesax online loans feature varying repayment structures, including installment-based repayments or lump-sum payments. Borrowers are required to adhere to the agreed-upon repayment schedule, ensuring that payments are made in a timely manner to avoid any potential penalties or negative impacts on their credit history.

Conclusion

In conclusion, applying for a Pesax online loan involves meeting specific eligibility requirements, completing the application process, undergoing evaluation and approval, receiving the disbursed funds, and adhering to the repayment structure. Understanding these elements is crucial for individuals considering a Pesax online loan, as it allows them to make informed decisions when seeking financial assistance.

The above content provides a comprehensive overview of the application conditions and process for obtaining a Pesax online loan, offering valuable insights for those navigating the borrowing journey.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status