How are the interest rates and fees for Pesax online loans calculated?

Pesax is an online lending platform that allows individuals to apply for personal loans. However, before applying for a loan, it is essential to understand how the interest rates and fees are calculated. This article will detail the process of calculating interest rates and fees for Pesax online loans.

What are Pesax Online Loans?

Pesax online loans are personal loans that are offered by financial institutions through their online platform. These loans can be used for various purposes, such as debt consolidation, home renovations, or unexpected expenses. They are typically unsecured loans, which means that the borrower does not need collateral to secure the loan.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

How are Interest Rates Calculated?

The interest rate on a Pesax online loan is based on various factors, including the borrower’s credit score, employment history, income, and debt-to-income ratio. The higher the credit score, the lower the interest rate, as the borrower is considered less risky. The lender may also consider the purpose of the loan and the loan term when setting the interest rate. The interest rate is typically expressed as an annual percentage rate (APR), which includes the interest rate and any applicable fees.

What Fees are Associated with Pesax Online Loans?

Pesax online loans may have various fees associated with them, including origination fees, late fees, prepayment fees, and insufficient fund fees. The origination fee is charged by the lender and is typically a percentage of the loan amount. Late fees are charged when the borrower misses a payment, and prepayment fees are charged if the borrower pays off the loan before the end of the loan term. Insufficient fund fees are charged when the borrower’s bank account does not have enough funds to cover a payment.

How are Fees Calculated?

The fees associated with Pesax online loans are typically a percentage of the loan amount or a flat fee. For example, origination fees may be 1% to 5% of the loan amount, while late fees may be a flat fee of $25 to $50. Prepayment fees may be a percentage of the remaining balance or a flat fee, depending on the lender’s policy.

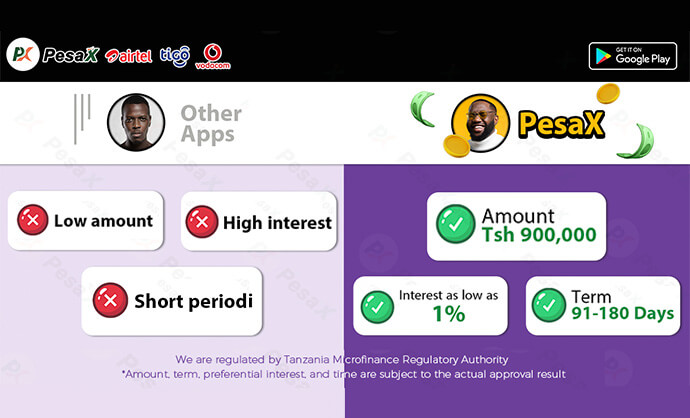

How to Compare Pesax Online Loans?

To compare Pesax online loans, borrowers should consider the interest rate, fees, loan term, and loan amount. Borrowers should also check if there are any prepayment penalties or other hidden fees. It is essential to read the loan agreement carefully before signing to ensure that all terms and conditions are understood.

Conclusion

In conclusion, Pesax online loans are a convenient way to obtain personal loans. However, borrowers should understand how interest rates and fees are calculated to make an informed decision. By comparing different loan options, borrowers can find the best loan for their needs and avoid any unexpected fees.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status