Will Pesax online loans be listed on the credit bureau?

In recent years, online lending platforms have gained popularity as convenient alternatives to traditional banks. One such platform is Pesax, which offers quick and easy loans to individuals. However, many borrowers are left wondering whether these loans will be reported to the credit reporting system. In this article, we will explore the topic in detail and provide a comprehensive overview of whether Pesax online loans will be included in the credit reporting system.

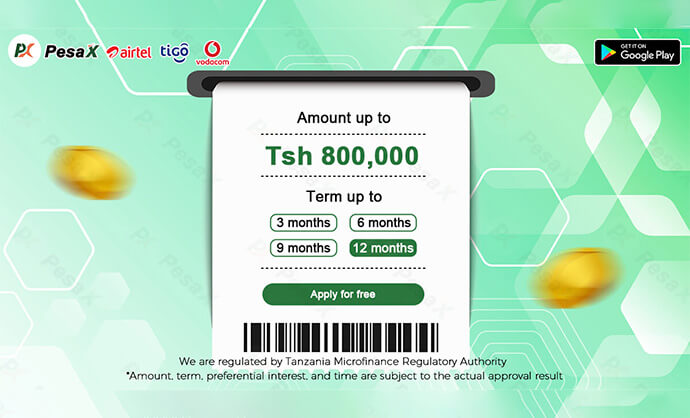

Introduction to Pesax Online Loans

Pesax is an online lending platform that provides accessible and efficient financial solutions to individuals. It offers various types of loans, including personal loans, business loans, and payday loans. The application process is simple and can be completed online, making it convenient for borrowers who are seeking quick access to funds.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

The Role of Credit Reporting System

The credit reporting system plays a crucial role in assessing an individual’s creditworthiness. It collects data on an individual’s borrowing and repayment history from various sources, such as banks, credit card companies, and other financial institutions. This information is then used by lenders to evaluate the creditworthiness of borrowers and make informed decisions regarding loan approvals.

Pesax’s Approach to Credit Reporting

At present, Pesax does not report loan information to the credit reporting system. This means that if you borrow from Pesax, your loan activity and repayment history will not be reflected in your credit report. This can be both advantageous and disadvantageous for borrowers, depending on their specific circumstances.

Advantages of Not Reporting to Credit Reporting System

One advantage of Pesax not reporting to the credit reporting system is that it allows individuals with poor or limited credit history to access loans. Traditional lenders often rely heavily on credit scores when evaluating loan applications. By not reporting to the credit reporting system, Pesax provides an opportunity for individuals who may not meet the strict credit requirements of traditional lenders to obtain much-needed funds.

Another advantage is the potential for privacy. Some borrowers prefer to keep their financial activities private and may not want their loan information to be accessible to lenders or other parties. Pesax’s approach respects this preference by not reporting loan information to the credit reporting system.

Disadvantages of Not Reporting to Credit Reporting System

On the other hand, not reporting loan information to the credit reporting system can have disadvantages as well. The credit reporting system serves as a means for individuals to establish and build credit history. By not reporting loan activity, borrowers may miss out on the opportunity to improve their creditworthiness through timely loan repayments.

Additionally, not having loan activity reported may limit borrowers’ ability to access credit in the future. Other lenders may rely on credit reports to assess the risk associated with lending to an individual. Without a documented loan history, borrowers may find it challenging to secure loans from other financial institutions.

Conclusion

In summary, Pesax online loans are currently not included in the credit reporting system. While this has advantages such as accessibility for individuals with limited credit history and privacy, it also has disadvantages such as the inability to improve creditworthiness and potential limitations in accessing credit from other lenders. It is important for borrowers to carefully consider their financial goals and circumstances before opting for Pesax online loans.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status