Does the Tanzania PesaX loan application require collateral or a guarantor?

The PesaX loan app has gained increasing popularity in Tanzania due to its convenient and efficient loan application process. One of the key concerns for potential borrowers is whether the app requires collateral or guarantors for loan approval. In this article, we will explore the lending requirements of the PesaX app, addressing the need for collateral or guarantors and providing a comprehensive overview of the loan application process.

The PesaX Loan Application Process

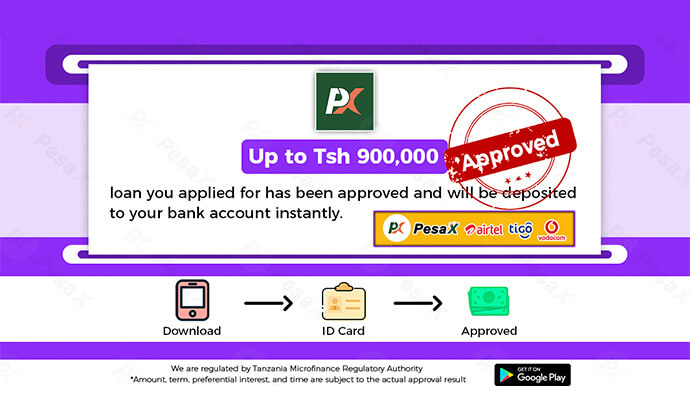

The PesaX loan application process is designed to be straightforward and accessible for users. Prospective borrowers can download the PesaX app from the Google Play Store, create an account, and submit a loan application directly from their mobile devices. The app offers various loan products with different repayment terms and interest rates, allowing individuals to select the option that best suits their needs.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

Collateral Requirements

One of the significant advantages of the PesaX loan app is that it does not require collateral for loan approval. This means that borrowers do not have to pledge assets such as property, vehicles, or valuable possessions to secure a loan through the app. The absence of collateral makes the loan application process more accessible to a broader segment of the population, especially those who may not possess significant assets to use as security.

Guarantor Expectations

Unlike traditional lending institutions that often mandate the involvement of guarantors for loan approvals, the PesaX loan app does not require borrowers to provide guarantors. This aspect simplifies the loan application process, as individuals are not tasked with finding suitable guarantors to vouch for their creditworthiness. By eliminating the need for guarantors, the app streamlines the lending experience and reduces the burden on potential borrowers.

Assessment Criteria

While the PesaX loan app does not necessitate collateral or guarantors, it does employ alternative assessment criteria to evaluate the creditworthiness of applicants. The app utilizes advanced algorithms and data analytics to assess the financial profiles of potential borrowers, considering factors such as income, spending patterns, and repayment history. This approach enables the app to make informed lending decisions without solely relying on traditional collateral or guarantor requirements.

Transparent Terms and Conditions

The PesaX app provides borrowers with transparent terms and conditions regarding loan products, including interest rates, repayment schedules, and any associated fees. By offering clear and comprehensible information, the app empowers individuals to make informed decisions about their borrowing activities. This transparency contributes to a more trustworthy and user-friendly lending platform, fostering a positive borrowing experience for users.

Conclusion: Accessible Lending Without Collateral or Guarantors

In conclusion, the PesaX loan app in Tanzania distinguishes itself by offering accessible lending solutions without imposing collateral or guarantor requirements on borrowers. The app’s user-friendly interface, transparent terms, and simplified application process contribute to its appeal among individuals seeking financial assistance. By leveraging innovative assessment methods, the app expands access to credit while minimizing traditional barriers associated with collateral and guarantor obligations.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status