What is the repayment period on PesaX Loan App in Tanzania?

The PesaX loan app has gained significant popularity in Tanzania due to its easy-to-use interface and quick loan disbursal process. One crucial aspect that borrowers need to understand is the repayment period for the loans obtained through this app. In this article, we will explore the details of the repayment period offered by PesaX and highlight its key features.

1. Introduction to PesaX

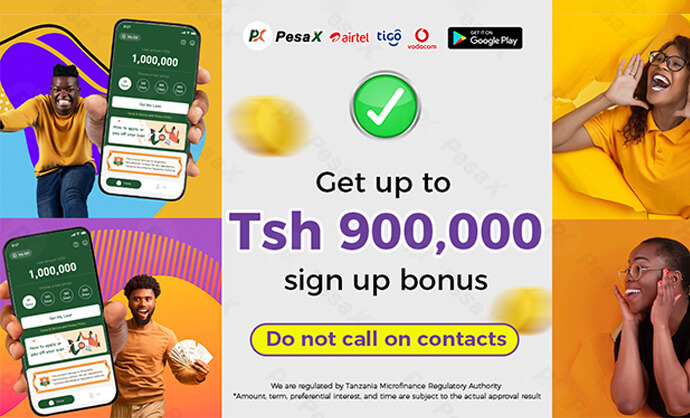

PesaX is a mobile loan app that allows Tanzanian individuals to access instant loans conveniently. The app utilizes advanced algorithms and data analysis to determine the creditworthiness of borrowers, making it easier for individuals with limited credit history to obtain loans. With a seamless application process and quick approval, PesaX has become a preferred choice for many Tanzanians in need of urgent funds.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

2. Loan Repayment Options

PesaX offers flexible repayment options to borrowers, ensuring that they can choose a plan that best suits their financial situation. The app provides various loan terms, ranging from short-term loans to longer-term installment loans. Borrowers can select the repayment period according to their preferences, allowing them to manage their finances effectively.

3. Short-Term Loans

Short-term loans offered by PesaX typically have a repayment period ranging from 7 to 30 days. These loans are ideal for borrowers who require immediate funds but expect to repay the loan within a relatively short span of time. The shorter repayment period helps borrowers avoid accumulating excessive interest charges and ensures a quick resolution of their debt.

4. Medium-Term Loans

For individuals who need a bit more time to repay their loans, PesaX also offers medium-term loans. These loans usually have a repayment period of 1 to 3 months. The extended timeframe provides borrowers with more flexibility in managing their finances and allows them to make smaller monthly repayments without feeling overwhelmed.

5. Long-Term Installment Loans

PesaX recognizes that some borrowers may require larger loan amounts and longer repayment periods. To cater to these needs, the app offers long-term installment loans. These loans can have a repayment period of up to 12 months, allowing borrowers to spread their repayments over several months. This feature is particularly useful for individuals facing significant financial commitments or those planning to invest the loan amount in income-generating activities.

6. Early Repayment and Penalty Charges

PesaX encourages responsible borrowing and allows borrowers to repay their loans before the agreed-upon due date. Early repayment helps borrowers save on interest charges and improves their creditworthiness for future loan applications. However, it is essential to note that PesaX may impose penalty charges for early repayment, which vary depending on the loan amount and the remaining tenure.

Conclusion

Understanding the repayment period is crucial when utilizing the PesaX loan app in Tanzania. With a range of loan terms available, borrowers can select the repayment period that aligns with their financial capabilities. Whether it is a short-term loan for immediate cash needs or a long-term installment loan for larger expenses, PesaX provides flexibility to meet diverse borrowing requirements. By considering the various repayment options and adhering to the terms and conditions, borrowers can effectively manage their loans and improve their financial well-being.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status