What are the service hours and service scope of PesaX Loan App in Tanzania?

PesaX is a loan application service operating in Tanzania. This article provides a comprehensive overview of its service time and coverage. It aims to provide relevant information for users interested in utilizing PesaX’s services.

1. Service Time

PesaX operates 24 hours a day, 7 days a week, allowing users to access their services at any time. This round-the-clock availability ensures convenience for individuals who need immediate financial assistance outside regular business hours. Whether it’s early in the morning or late at night, PesaX is there to assist borrowers in fulfilling their financial needs.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

2. Service Coverage

PesaX extends its services throughout the entire country of Tanzania. Regardless of one’s location within the country, as long as there is an internet connection, users can access PesaX’s loan application platform. This wide coverage ensures that individuals in rural as well as urban areas can easily apply for loans without the need for physical visits to a loan provider.

3. Loan Application Process

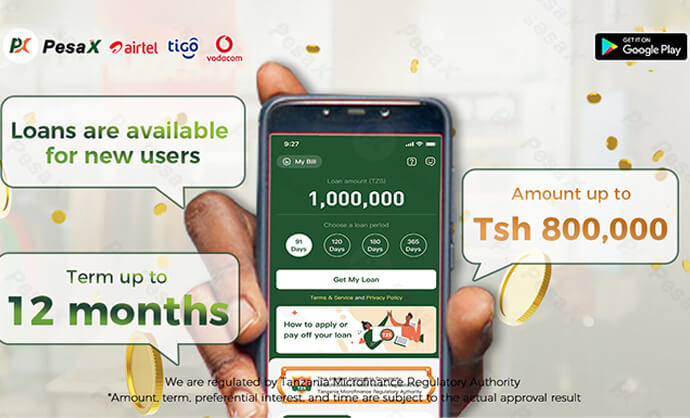

To apply for a loan through PesaX, users need to download the PesaX mobile application from their smartphone’s app store. After installation, users are required to create an account by providing personal information and verifying their identity. Once the account is set up, users can proceed to fill out the loan application form, specifying the desired loan amount and repayment duration.

4. Loan Approval and Disbursement

After submitting the loan application, PesaX evaluates the user’s eligibility based on various factors such as credit history, repayment capability, and personal information. The evaluation process is quick, typically taking a few minutes. Upon approval, the loan amount is disbursed directly to the borrower’s registered bank account or mobile money wallet.

5. Repayment Options

PesaX offers flexible repayment options to its borrowers. Users can choose to repay their loans in weekly, bi-weekly, or monthly installments. The repayment schedule is communicated to the borrower upon loan approval, ensuring transparency and clarity. Additionally, PesaX provides a grace period for early repayments and offers the option to extend the loan duration if necessary.

6. Customer Support

PesaX values customer satisfaction and provides reliable customer support services. Users can reach out to the PesaX support team through various channels such as phone, email, or live chat within the mobile application. The support team is available to assist users with any queries, concerns, or technical issues they may encounter during the loan application or repayment process.

Conclusion

In conclusion, PesaX is a loan application service that operates 24/7 throughout Tanzania. It offers a convenient and accessible platform for individuals to apply for loans at any time and from any location within the country. With a simple application process, quick approval, flexible repayment options, and reliable customer support, PesaX strives to meet the diverse financial needs of Tanzanians. Whether it’s for emergency purposes or personal investments, PesaX aims to provide a seamless borrowing experience.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status