What is the application process for PesaX Loan App in Tanzania?

Applying for a loan has become easier than ever with the advent of online lending platforms. In Tanzania, one such platform is PesaX, which offers a convenient way for individuals to access quick loans. This article will guide you through the application process for a loan on the PesaX loan app, providing a detailed and comprehensive overview. By following these steps, you can easily apply for a loan and meet your financial needs.

Step 1: Download the PesaX Loan App

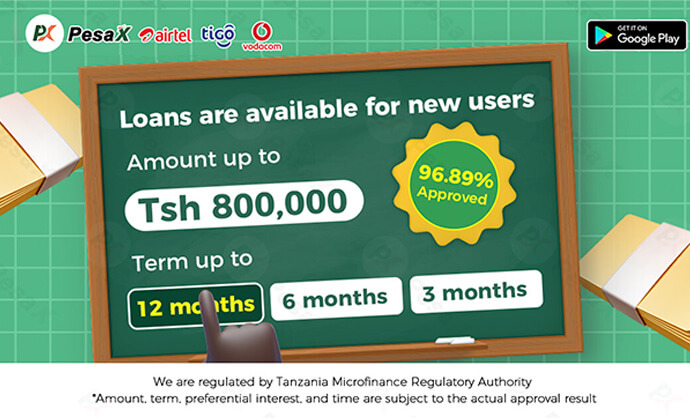

The first step in applying for a loan through PesaX is to download the PesaX loan app onto your smartphone. The app is available for both Android and iOS devices, making it accessible to a wide range of users. Simply visit the Google Play Store or Apple App Store, search for “PesaX Loan App,” and click on the download button. Once the app is downloaded and installed, you’re ready to begin the application process.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

Step 2: Register an Account

After successfully installing the PesaX loan app, you need to register an account. Open the app and click on the “Register” button to create a new account. You will be prompted to provide your personal information, including your full name, phone number, email address, and a password. Ensure that the information you provide is accurate and complete. Once you have filled in all the required fields, click on the “Register” button to proceed.

Step 3: Complete Your Profile

Once you have registered an account, the next step is to complete your profile. Click on the “Profile” section within the app and provide additional details, such as your employment status, monthly income, and any existing loans. This information will help PesaX assess your creditworthiness and determine the loan amount you are eligible for. Make sure to provide accurate information to avoid any discrepancies during the loan application process.

Step 4: Apply for a Loan

Now that your profile is complete, you can proceed to apply for a loan. Within the PesaX app, navigate to the “Loan” section and click on the “Apply for a Loan” button. You will be presented with a loan application form, where you need to fill in details such as the desired loan amount, loan duration, and purpose of the loan. Take your time to accurately complete the application form, as any errors or inconsistencies may lead to delays or rejection of your loan application.

Step 5: Wait for Approval

After submitting your loan application, all you need to do is wait for approval. PesaX will review your application and assess your creditworthiness based on the information provided. This process usually takes a short period of time, and you will receive a notification on your smartphone once a decision has been made. If your application is approved, the loan amount will be disbursed directly to your PesaX account or your linked mobile money account.

Step 6: Repay Your Loan

Once you have received the loan, it’s important to repay it on time to avoid any penalties or negative impact on your credit score. PesaX provides various repayment options, including mobile money payments or bank transfers. Ensure that you have sufficient funds in your account on the due date to make the repayment. Timely repayment will also improve your creditworthiness, making it easier for you to access larger loan amounts in the future.

In conclusion, the PesaX loan app offers a simple and efficient way for Tanzanians to apply for loans. By following these six steps – downloading the app, registering an account, completing your profile, applying for a loan, waiting for approval, and repaying the loan – you can access quick funds to meet your financial needs. Remember to provide accurate information and repay your loan on time to establish a good credit history. Download the PesaX loan app today and experience the convenience of online lending in Tanzania.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status