How competitive is the Tanzania PesaX loan app in the local market?

Tanzania’s financial landscape has seen a significant transformation with the advent of digital lending platforms. PesaX, a prominent loan app, has emerged as a key player in this arena, catering to the borrowing needs of Tanzanians. In this article, we will delve into the competitive dynamics of the PesaX loan app within the local market, examining its strengths, weaknesses, and the strategies it employs to stay ahead in the race.

The Rise of Digital Lending in Tanzania

In recent years, Tanzania has witnessed a surge in the popularity of digital lending apps, offering quick and convenient access to funds for individuals and small businesses. PesaX has capitalized on this trend by providing seamless loan application processes, minimal documentation requirements, and swift disbursement of funds. Its user-friendly interface and efficient customer service have contributed to its growing prominence in the Tanzanian financial sector.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

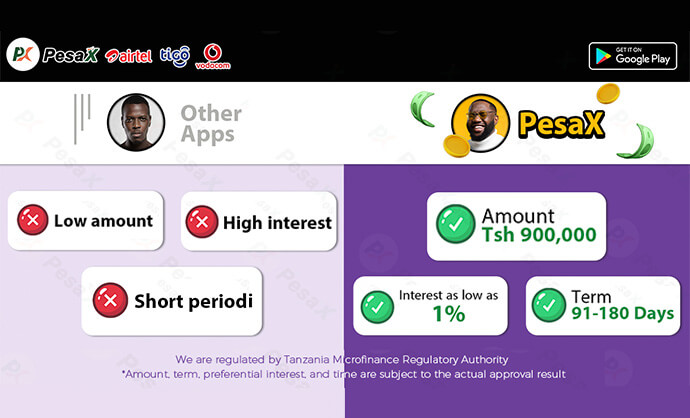

PesaX’s Unique Value Proposition

PesaX sets itself apart through its tailored loan products, catering to a wide spectrum of borrowers, including those with limited credit history. The app’s algorithmic credit scoring system and risk assessment mechanisms enable it to extend credit to underserved segments of the population. Moreover, PesaX’s partnerships with local businesses and organizations have facilitated the development of targeted loan offerings, further enhancing its appeal in the market.

Challenges and Opportunities

While PesaX enjoys a competitive edge, it faces challenges typical of the digital lending landscape, such as regulatory compliance, customer data security, and maintaining a balance between accessibility and responsible lending practices. Furthermore, the evolving technological landscape presents opportunities for innovation, prompting PesaX to continually enhance its app’s features, streamline its processes, and expand its reach to untapped market segments.

Strategic Partnerships and Expansion

To consolidate its position in the market, PesaX has actively pursued strategic partnerships with banks, microfinance institutions, and fintech companies. These collaborations have not only broadened the app’s range of financial products but also facilitated the integration of additional services, such as insurance and investment options, thereby enriching the overall customer experience. PesaX’s expansion into rural areas and underserved regions underscores its commitment to financial inclusion.

The Road Ahead

In conclusion, the competitive landscape of digital lending in Tanzania is dynamic, with PesaX emerging as a formidable player. Its emphasis on leveraging technology, understanding local nuances, and forging strategic alliances positions it favorably within the market. As it navigates the intricacies of the financial sector, PesaX continues to adapt, innovate, and uphold its commitment to providing accessible and sustainable financial solutions to the people of Tanzania.

—

The competitive environment of the PesaX loan app in Tanzania is shaped by various factors, including market dynamics, technological advancements, and regulatory frameworks. PesaX has managed to carve a niche for itself by offering tailored loan products, fostering strategic partnerships, and addressing the financial needs of diverse customer segments. As the digital lending landscape continues to evolve, PesaX remains steadfast in its pursuit of providing inclusive and impactful financial services to the Tanzanian populace.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status