What are the user reviews and reputation of the PesaX Loan App in Tanzania?

In today’s digital age, financial technology has revolutionized the way people access financial services. In Tanzania, the PesaX loan app has gained significant attention. This article delves into the user ratings and word of mouth surrounding the PesaX app, providing an in-depth analysis of its performance and reception.

The Concept of PesaX Loan App

PesaX is a mobile loan application that provides convenient and accessible financial services to Tanzanians. The app offers quick and easy access to loans, enabling users to meet their financial needs promptly. With a user-friendly interface and simple loan application process, PesaX aims to cater to the diverse financial requirements of its users.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

User Experience and Interface

The user experience and interface of PesaX have garnered mixed reviews. Some users appreciate the simplicity of the app, praising its intuitive design and easy navigation. However, others have expressed concerns regarding occasional glitches and slow responsiveness. The app’s interface has been commended for its clear layout, but there are ongoing discussions about potential improvements to enhance overall user experience.

Loan Approval Process

One of the critical aspects of any loan app is its approval process. PesaX has received positive feedback for its swift loan approval mechanism. Users have highlighted the app’s efficiency in processing loan applications, often receiving funds in a timely manner. However, there have been reports of technical issues causing delays in some cases, prompting discussions about the need for streamlined approval procedures.

Customer Service and Support

The perception of PesaX’s customer service and support varies among users. While some have lauded the app for responsive and helpful customer service, others have voiced dissatisfaction with the handling of queries and concerns. The availability of reliable customer support is crucial for building trust and confidence among users, prompting discussions on ways to improve the overall support system.

Interest Rates and Transparency

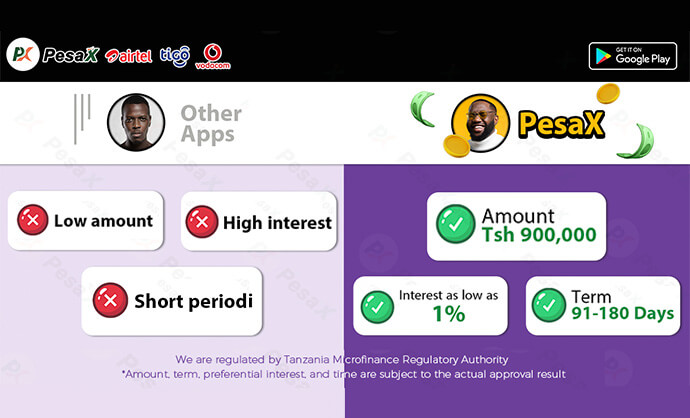

The transparency of interest rates and associated fees is a significant factor influencing user perceptions of PesaX. While the app has been praised for its transparent fee structure, some users have raised concerns about high-interest rates. Discussions have emerged regarding the need for enhanced transparency and education about the financial implications of utilizing the app’s services.

Security and Data Privacy

In the digital realm, security and data privacy are paramount. PesaX has been subjected to discussions about its approach to safeguarding user data and ensuring secure transactions. While the app has implemented robust security measures, there are ongoing conversations about reinforcing data privacy protocols and enhancing overall security to instill greater confidence among users.

Conclusion

In conclusion, the PesaX loan app in Tanzania has elicited diverse opinions and feedback from its users. While the app offers a convenient platform for accessing financial assistance, there are areas that have sparked discussions and suggestions for improvement. By addressing the concerns related to user experience, loan approval processes, customer service, transparency, and security, PesaX can further solidify its position as a trusted and reliable financial tool for Tanzanians.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status