Are there any risks or caveats with the Tanzania PesaX loan app?

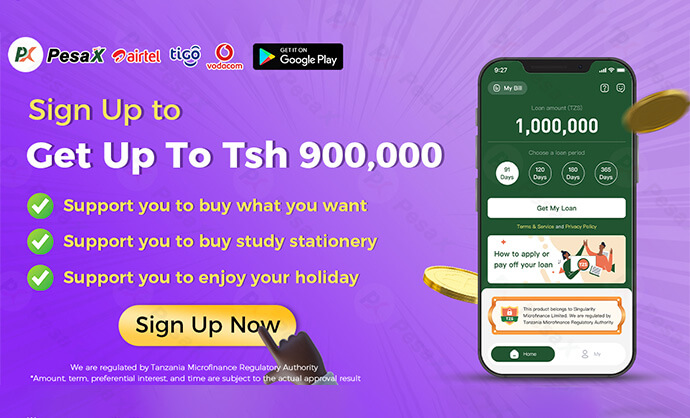

In recent years, mobile lending applications have become popular in Tanzania due to their ease of access and convenience. PesaX is one such app that provides loans to individuals based on their credit score and repayment capacity. However, before considering taking a loan from PesaX, it is essential to understand the risks and precautions associated with the app.

The Risks of Using PesaX

Like any other loan app, PesaX has its share of risks. The first and foremost is the possibility of falling into a debt trap. The app offers loans at high-interest rates, which can quickly accumulate if not repaid on time. Further, the app may offer loans beyond an individual’s repayment capacity, leading to a cycle of debt.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

The second risk is related to cybersecurity. Mobile lending apps gather personal information such as ID numbers, bank account details, and phone numbers. This information can fall into the wrong hands, leading to identity theft and fraud.

Precautions to Take When Using PesaX

To avoid falling into a debt trap or becoming a victim of cybercrime, users of PesaX should take several precautions. Firstly, they should only borrow what they need and can repay within the given time frame. Secondly, users should ensure that the app is secure and their personal information is protected. They can do this by checking the app’s privacy policy and terms of service.

Thirdly, users should read and understand the terms and conditions of the loan before accepting it. They should also compare the interest rates and fees charged by different loan providers to ensure they are getting the best deal.

The Benefits of Using PesaX

Despite the risks associated with PesaX, the app offers several benefits to users. Firstly, it provides quick access to credit, which can be helpful in emergencies or when individuals need urgent cash. Secondly, the app offers flexible repayment options, making it easier for borrowers to repay their loans.

Thirdly, PesaX does not require collateral to provide loans, making it accessible to a wider range of individuals. Fourthly, PesaX uses artificial intelligence and machine learning to analyze an individual’s creditworthiness, making the loan approval process faster and more efficient.

The Future of Mobile Lending Apps in Tanzania

Mobile lending apps like PesaX are becoming increasingly popular in Tanzania, with more individuals turning to them for quick and convenient access to credit. However, as the industry grows, there is a need for tighter regulations and oversight to protect consumers from risks such as high-interest rates and cybercrime.

The government of Tanzania has already taken steps to regulate the industry. In 2018, it introduced regulations that require mobile lending apps to register with the Bank of Tanzania and comply with certain rules and standards. This move is expected to improve transparency and accountability in the industry.

Conclusion

In conclusion, PesaX is a useful tool for individuals who need quick access to credit. However, it is essential to understand the risks associated with the app and take precautions to avoid falling into a debt trap or becoming a victim of cybercrime. By borrowing responsibly and staying informed, individuals can make the most of PesaX and other mobile lending apps while safeguarding their financial security.

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status