How are emergency loan interest rates and fees calculated?

Emergency loans can be a lifesaver in times of financial crisis. However, before applying for this type of loan, it’s important to understand how interest rates and fees are calculated. In this article, we’ll discuss in detail how emergency loan interest rates and fees are calculated.

What is an emergency loan?

Emergency loans are short-term loans designed to assist individuals during financial emergencies. These loans are typically offered by banks, credit unions, or online lenders. Emergency loans can be used to cover unexpected expenses, such as medical bills, car repairs, or home repairs.

Online Credit Loans

Loan Amount

TZS 1,200,000

Quick Payment In

5 Minutes

How is the emergency loan interest rate calculated?

Emergency loan interest rates are calculated based on a variety of factors, including the borrower’s credit score, income, and debt-to-income ratio. Lenders will also consider the loan amount and repayment term. Generally speaking, emergency loans have higher interest rates than traditional loans because they are riskier to the lender.

What are the different types of emergency loan interest rates?

Emergency loans come with two interest rates: fixed and floating. Fixed interest rates remain the same throughout the life of the loan, while floating rates fluctuate based on market conditions. Fixed rates are more predictable, while variable rates can increase or decrease over time.

How much does an emergency loan cost?

The total cost of an emergency loan depends on a variety of factors, including interest rate, fees, loan amount, and repayment term. To determine the total cost of a loan, borrowers should use a loan calculator that takes all of these factors into consideration. Before accepting a loan offer, be sure to consider the total cost of the loan.

Conclusion

Emergency loans can be a useful tool for individuals in financial need, but it’s important to understand how interest rates and fees are calculated before applying for such a loan. Borrowers should compare offers from different lenders and use a loan calculator to determine the total cost of the loan. Armed with this knowledge, borrowers can make an informed decision about whether an emergency loan is right for their financial situation.

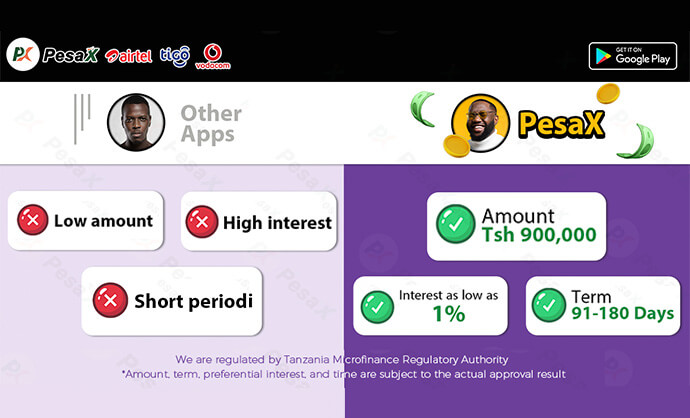

PesaX - Online Loan applicaition

5.0(1 millón +)

Security Status

PesaX - Online Loan applicaition

5.0 (1 million +)

Security Status